Loading

Get Ct Ct-w4p 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT CT-W4P online

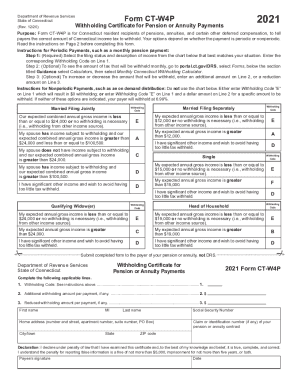

The CT CT-W4P form is essential for Connecticut residents receiving pensions or annuities, as it determines the amount of state income tax to withhold. This guide will walk you through the steps to fill out the CT CT-W4P form online with clarity and confidence.

Follow the steps to complete the CT CT-W4P form online effectively.

- Click 'Get Form' button to access the CT CT-W4P form and open it in your preferred online editor.

- Begin by selecting your filing status and income description from the provided chart. Enter the corresponding Withholding Code on Line 1.

- If desired, you can check your expected tax withholding amount by using the Monthly Connecticut Withholding Calculator via the relevant online portal.

- To modify the withholding amount, enter any additional amount you wish to be withheld on Line 2 or a reduction amount on Line 3.

- If you are submitting details for nonperiodic payments, enter Withholding Code 'E' on Line 1 for zero withholding or specify a dollar amount on Line 2 for a specific withholding amount.

- Provide your first name, middle initial, last name, address, Social Security Number, and claim or identification number of your pension or annuity contract as requested in the form.

- Read the declaration clause carefully. Sign and date the form to confirm that the information is accurate.

- Save your changes and download, print, or share the completed CT CT-W4P form according to your needs.

Start filling out your CT CT-W4P form online today to ensure the correct tax withholding for your pension or annuity payments.

Connecticut State Payroll Taxes It's a progressive income tax that ranges from 3% to 6.99%. Connecticut does not have any local city taxes, so all of your employees will pay only the state income tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.