Loading

Get Al Adv-40 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL ADV-40 online

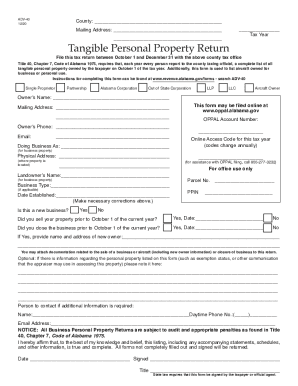

The AL ADV-40 form is essential for reporting tangible personal property owned by taxpayers in Alabama. This guide provides clear, step-by-step instructions on how to complete this form online, ensuring you meet your tax responsibilities accurately and efficiently.

Follow the steps to complete the AL ADV-40 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editing tool.

- Fill in the county and tax year at the top of the form. This information is crucial for identifying where and for which year you are reporting your property.

- Provide your mailing address, including street address, city, state, and zip code. Ensure that this information is complete for accurate correspondence.

- Indicate whether you are a single proprietor, a partner in a partnership, an Alabama corporation, or any other business entity by checking the appropriate box.

- Enter the owner's name and contact information, including phone number and email address. This allows tax officials to reach you if needed.

- Complete the ‘Doing Business As’ section if applicable, along with the physical address where the property is located. This helps clarify the business identity and location.

- In the business type section, specify what type of business you operate and the date it was established. Confirm if this is a new business by selecting Yes or No.

- Address the questions about selling property or closing the business prior to October 1 by checking Yes or No and providing relevant dates if applicable.

- Complete Part A by listing the items of tangible personal property you own. Include details such as the date acquired, item description, and cost. Use additional sheets if necessary.

- If applicable, proceed to Part B to report on motor vehicles with add-on or specialized equipment by filling out details including model, year, purchase price, and vehicle identification number.

- Continue to Part C if you own any aircraft. Fill in the required details, including the type of aircraft, model, serial number, and acquisition cost.

- If you have construction in progress, provide the necessary details in Part D, including anticipated in-service dates and total costs.

- For leased or rented items, complete Part E by providing lessor information and details about the equipment.

- Complete Part F if you possess personal property owned by someone else. Provide the owner's information and address in this section.

- Review all entries for accuracy. Finally, save changes, download, or print the form for submission. Ensure that it is signed and dated as required before submission.

Start completing your AL ADV-40 online today to ensure compliance with tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.