Loading

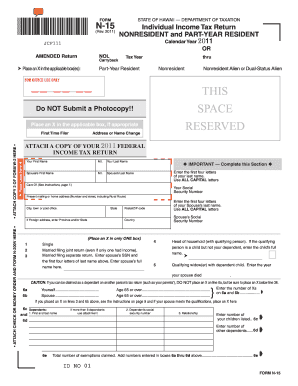

Get Hawaii N 15 2011 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hawaii N 15 2011 Form online

Filling out the Hawaii N 15 2011 Form online is a straightforward process that ensures accurate submission of your state income tax return as a nonresident or part-year resident. This guide will walk you through each section of the form to help you complete it efficiently and correctly.

Follow the steps to fill out the Hawaii N 15 2011 Form online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify your filing status by placing an X in the applicable box. Options include single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Provide your personal information, including your first name, middle initial, last name, and your Social Security number. For married couples, fill out your spouse's information as well.

- Enter your mailing address, including city, state, and postal code. If you are using a foreign address, ensure to include the province or state.

- Detail your total and Hawaii income by filling out the income sections in columns A and B. Be sure to attach Form(s) W-2 as necessary for wages.

- Calculate your adjustments by providing information on deductions and other income, ensuring to follow the instructions closely for each section.

- Summarize your total income, adjusted gross income, and any applicable deductions by following the logical flow through the provided fields.

- Complete the section for tax credits by indicating any that apply to your situation, such as low-income credits, child care credits, etc.

- If you expect a refund, follow the instructions for providing bank account details for direct deposit. Alternatively, if you owe money, indicate the payment method.

- Finally, review your completed form for accuracy, save your changes, and download a copy for your records. You may also print or share the form as needed.

Complete your Hawaii N 15 2011 Form online today for a seamless tax filing experience.

Form N-15 is filed by nonresident individuals who have Hawaii tax liability and by individuals who are Hawaii residents for only part of the tax year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.