Loading

Get E 595e

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the E 595e online

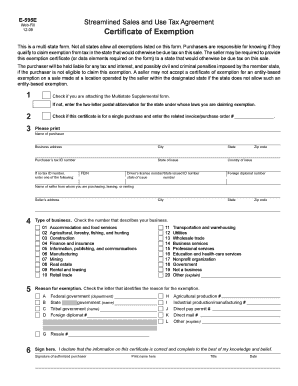

The E 595e form serves as a Certificate of Exemption under the Streamlined Sales and Use Tax Agreement. It allows purchasers to claim exemptions from sales tax for specific transactions. This guide provides clear, step-by-step instructions to help users successfully complete the form online.

Follow the steps to complete the E 595e form online.

- Click ‘Get Form’ button to obtain the E 595e form and open it for editing.

- Determine if you are attaching the Multistate Supplemental form. If not, enter the two-letter postal abbreviation for the state under whose laws you are claiming exemption.

- Indicate if this certificate is for a single purchase by checking the appropriate box and entering the corresponding invoice or purchase order number.

- Fill out the purchaser’s information, including the name, business address, city, state, zip code, and tax identification number, if applicable.

- Provide the seller’s information, including their name and business address, as requested.

- Select the type of business that best describes your organization by checking the corresponding number.

- Check the letter that identifies the reason for your exemption. Include any additional information requested based on the exemption selected.

- Sign the form to declare that the information provided is correct and complete, providing your printed name, title, and date.

- After reviewing all entries for accuracy, you can save changes, download, print, or share the completed E 595e form.

Complete your E 595e form online today for a hassle-free exemption process.

To qualify for farm tax exemption in North Carolina, ensure your land meets the state's agricultural requirements, including income generation from farming activities. Proper documentation, including the E 595e form, is crucial for maintaining compliance and maximizing benefits. Consulting local agricultural offices can provide additional insights into the qualification process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.