Loading

Get Commonwealth Of Dominica Form Vat-001 25 October 2005 - Ird Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the COMMONWEALTH OF DOMINICA Form VAT-001 25 October 2005 - Ird Gov online

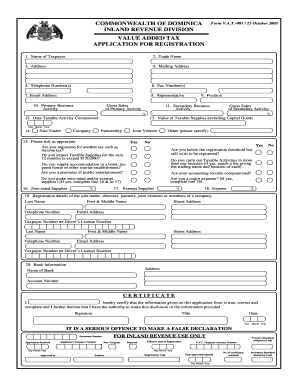

This guide provides clear, step-by-step instructions for completing the COMMONWEALTH OF DOMINICA Form VAT-001. This form is essential for individuals and businesses seeking value-added tax registration, and filling it out correctly is crucial for compliance.

Follow the steps to complete the VAT-001 application form online.

- Click the ‘Get Form’ button to obtain the VAT-001 form and open it in an online editor.

- Enter the name of the taxpayer in the designated field. This should be the legal name of the individual or business applying for registration.

- Fill in the trade name, if applicable. This is the name under which the business operates, which may differ from the legal name.

- Provide the address of the business. Ensure that this is a physical address where the business is located.

- Input your mailing address. This may be the same as the physical address or a different location where you receive correspondence.

- List your telephone number(s) for contact purposes. Be sure to include any area codes.

- Enter any fax number(s) if you have them. This is optional but can facilitate communication.

- Provide your email address. This is important for receiving notifications and updates regarding your application.

- Identify your representative, if applicable. This could be someone acting on behalf of the taxpayer.

- Specify your primary business activity in the relevant section. This should be a clear and concise description.

- Indicate the gross sales of your primary activity. This is your total sales revenue from the main business activity.

- Fill in the date when your taxable activity commenced. Use the day, month, and year format.

- Complete the fields for the gross sales of your secondary activity, if applicable. Specify the sales figures and ensure accuracy.

- Select the type of business entity by ticking the appropriate box: sole trader, company, partnership, or joint venture.

- Answer the questions regarding other tax registrations and expectations for taxable supplies. Check 'yes' or 'no' as appropriate.

- Indicate if you carry out taxable activities in more than one location, and provide the necessary details if applicable.

- Provide details regarding zero-rated and exempt supplies, if any, in the designated fields.

- Certify that the information provided is true and correct. Include your title, signature, and the date of signing.

- Once all fields are completed, save your changes. You can download, print, or share the completed form as required.

Start completing your VAT registration form online today to ensure compliance and avoid penalties.

VAT – or value-added tax – is a tax levied on the sale of goods and services. In Dominica, the standard VAT rate is 15 percent. However, a reduced rate of 10 percent applies to hotels and diving companies. There are also some goods that have no VAT at all, such as goods for export (flour, milk, rice, sugar).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.