Loading

Get Ameriprise 403b Distribution Form 200702

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ameriprise 403b Distribution Form 200702 online

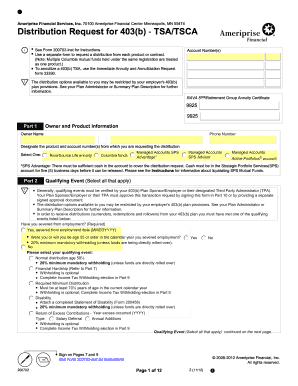

This guide provides step-by-step instructions for completing the Ameriprise 403b Distribution Form 200702 online. By following these instructions, users can seamlessly navigate the form and ensure that their distribution requests are processed efficiently.

Follow the steps to complete the distribution form online.

- Click the 'Get Form' button to obtain the form and open it in the editor.

- In Part 1, enter your owner information including your name and phone number. Specify the product and account number(s) from which you are requesting the distribution. Select one of the options provided, such as 'RiverSource Life annuity' or 'Columbia funds'.

- In Part 2, indicate the qualifying events that apply to your situation. You must verify these events with your 403(b) Plan Sponsor or employer. Fill in the required information, including the severance date if applicable.

- In Part 3, select the type of transaction you are initiating. Whether you are requesting a total or partial distribution, specify the amount or percentage of the distribution desired.

- In Part 4, provide payment and delivery instructions. Choose your preferred method for receiving the distribution, whether it be through mail or direct deposit, and fill out any additional required banking information.

- If applicable, complete Parts 5 and 6 for direct rollovers, internal transfers, or external exchanges, specifying the amounts and type of transactions.

- In Part 9, indicate your withholding instructions for federal income tax, ensuring to review your options based on the eligibility for rollover.

- Finally, in Part 10, sign and date the form, confirming your understanding and acknowledgment of the terms related to the distribution. Ensure you include approval from your Plan Sponsor where necessary.

- Once all sections are complete, save changes, download, print, or share the form as needed to finalize your request.

Complete your distribution documents online today for a smooth processing experience.

Related links form

A 10% penalty may apply to distributions of conversion assets made within five years of conversion and prior to age 59 ½ (exceptions apply). A 10% penalty may apply to taxable distributions of earnings prior to age 59 ½ (exceptions apply).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.