Loading

Get Missouri Transfer Form-2005.doc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Missouri Transfer Form-2005.doc online

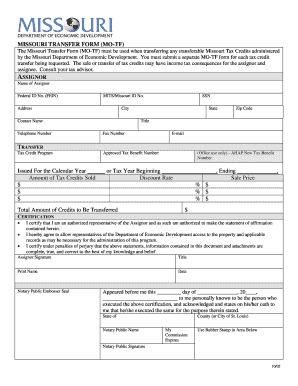

Filling out the Missouri Transfer Form is essential for transferring transferable tax credits administered by the Missouri Department of Economic Development. This guide will provide you with clear, step-by-step instructions to effectively complete the form online.

Follow the steps to complete the Missouri Transfer Form online

- Click the ‘Get Form’ button to access the form and open it in the online editor.

- Begin by filling out the 'Assignor' section. Provide the 'Name of Assignor,' 'Federal ID No. (FEIN),' 'MITS/Missouri ID No.,' 'Address,' 'City,' 'State,' and 'Zip Code.' Ensure all information is accurate.

- Input the 'Contact Name,' 'Telephone Number,' 'Fax Number,' and 'E-mail' for the Assignor to establish a point of contact.

- In the 'Transfer' section, specify the 'Tax Credit Program' and the 'Issued For the Calendar Year.' Enter the 'Amount of Tax Credits Sold' for each applicable credit.

- Complete the details regarding the 'Approved Tax Benefit Number' and provide information on any new tax benefit number or tax year. Enter the 'Discount Rate' and 'Sale Price.'

- Calculate and enter the 'Total Amount of Credits to Be Transferred' at the end of the Transfer section.

- Proceed to the 'Certification' section where the 'Assignor Signature,' 'Title,' 'Print Name,' and 'Date' must be entered. Ensure the signature is valid and placed where required.

- Next, complete the 'Assignee' section by filling out fields similar to the Assignor's section: 'Name of Assignee,' 'Federal ID No. (FEIN),' and other contact information.

- Indicate the 'Assignee Type' by circling the appropriate option (e.g., C Corp, S Corp, LLC, etc.). If applicable, provide details of beneficiaries or partners under this section.

- Finish by certifying the Assignee's information in the 'Certification' section with the required signature, title, print name, and date.

- Once all fields in the form are completed, save your changes. You can then download, print, or share the completed form as needed.

Complete your Missouri Transfer Form online today to ensure a smooth transfer of your tax credits.

The applicable statute of limitations for such collections to initiate a civil suit for the collection of delinquent taxes is five (5) years from the date of finality of the assessment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.