Loading

Get 2020 Schedule X California Explanation Of Amended Return Changes

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2020 Schedule X California Explanation Of Amended Return Changes online

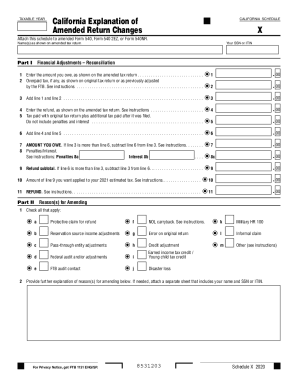

Filing an amended return can sometimes be necessary due to changes in your financial situation or corrections needed on your previous filing. This guide will assist you in accurately completing the 2020 Schedule X California Explanation of Amended Return Changes online to ensure your amendments are properly recorded.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to access the Schedule X document and open it in the editor.

- In Part I, enter your name(s) exactly as shown on your amended tax return.

- Provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) in the designated field.

- For line 1, input the amount you owe as shown on the amended tax return.

- On line 2, enter the overpaid tax, if any, from your original tax return or previous adjustments.

- Add lines 1 and 2 and write the total on line 3.

- For line 4, enter the refund amount as indicated on your amended tax return.

- Input the tax that was paid with the original return on line 5, excluding any penalties or interest.

- Add lines 4 and 5 to find the total and write it on line 6.

- If line 3 exceeds line 6, calculate your amount owed by subtracting line 6 from line 3 and enter it on line 7.

- If applicable, calculate penalties and interest for lines 8a and 8b.

- On line 9, if line 6 is greater than line 3, subtract line 3 from line 6 for your refund subtotal.

- On line 10, indicate the amount of line 9 that you would like applied to your 2021 estimated tax.

- Complete line 11 by entering your total refund amount.

- In Part II, check all appropriate reasons for amending your return.

- Provide further explanations for your amendments in the section provided and include a separate sheet if necessary.

- Review all entered information for accuracy.

- Once all fields are completed, save your changes, and download, print, or share your completed form as needed.

Get started on your amendments online today!

Simply complete Form 540 (if you're a resident) or Form 540NR and Schedule X (explanation of your amended return changes). Forms 540 and 540NR are Forms used for the Tax Return and Tax Amendment. Though you can prepare a 2022 California Tax Amendment Form on eFile.com, you cannot submit it electronically.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.