Loading

Get Fmf4irad

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fmf4irad online

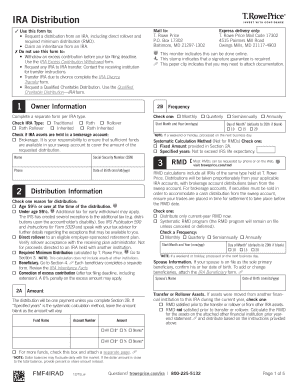

The Fmf4irad form is essential for requesting distributions from an Individual Retirement Account (IRA). This guide provides clear, step-by-step instructions to help users navigate through the online form efficiently.

Follow the steps to complete the Fmf4irad form online.

- Press the ‘Get Form’ button to access the IRA distribution form and open it for completion.

- Enter your personal information including your name, Social Security Number (SSN), phone number, and date of birth, ensuring all details are accurate.

- In the distribution information section, select the reason for the distribution. Options include being over age 59½, under age 59½, a direct rollover, or a required minimum distribution (RMD).

- Complete the amount section, detailing the distribution amount or leaving it blank if you are using specified years for calculation.

- In the owner information section, indicate the type of IRA (Traditional, Roth, Rollover, etc.) and provide account details as requested.

- If you are a beneficiary, complete section 4 with the necessary beneficiary information and the relationship to the IRA owner.

- Review the payment options, determining how you prefer to receive your funds, such as through electronic funds transfer or a mailed check.

- Sign the form to certify your information is accurate. If necessary, obtain a Medallion signature guarantee from your financial institution.

- Once you have completed all sections, save your changes, then download, print, or share the form as needed.

Complete your IRA distribution requests easily by filling out the Fmf4irad form online today.

Related links form

SECURE 1.0' s 10-year rule takes you through the end of 2030. As explained in IRS Publication 590-B, under the 10-year rule, “if the owner died in 2021, the beneficiary would have to fully distribute the IRA by December 31, 2031.”

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.