Loading

Get Fha Application Of Unused Escrow Funds Authorization - Pmac

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FHA application of unused escrow funds authorization - PMAC online

Filling out the FHA application of unused escrow funds authorization form is a crucial step in managing your escrow account. This guide will provide you with clear instructions on how to complete the form accurately and efficiently online.

Follow the steps to fill out the FHA application of unused escrow funds authorization online.

- Press the ‘Get Form’ button to access the FHA application of unused escrow funds authorization form and open it for editing.

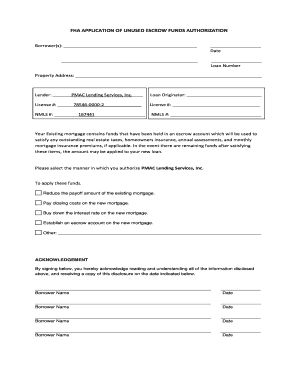

- Begin by entering the names of the borrower or borrowers in the designated field at the top of the form.

- Fill in the date in the format requested next to the borrower names.

- Input the loan number in the provided section on the form.

- Proceed to enter the property address in the appropriate field, ensuring accuracy for documentation purposes.

- Identify PMAC Lending Services, Inc. as your lender in the specified section.

- Enter the name of the loan originator and their license number in the corresponding fields.

- Complete the additional license number and NMLS number fields as required.

- Review the section regarding the existing mortgage, taking note of how remaining escrow funds will be utilized.

- Select your preferred method of authorizing the use of unused escrow funds by ticking the relevant options, such as applying funds, reducing payoff amounts, or covering closing costs.

- If selecting 'Other', provide details in the space provided.

- Each borrower must sign the acknowledgment section, confirming that they have read and understood the information, and fill in the date.

- Once all fields are completed, save your changes, and choose to download, print, or share the completed form.

Begin completing your FHA application of unused escrow funds authorization online today!

Though lenders and servicers typically require borrowers to have escrow accounts – particularly if they made a low down payment or have little equity in their home – it's sometimes possible to get a mortgage without an escrow account, or to have an existing escrow account removed from your loan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.