Loading

Get Brighthouse Financial Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Brighthouse Financial forms online

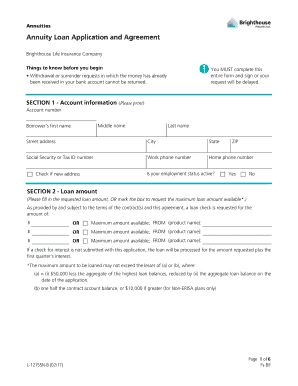

Filling out the Brighthouse Financial forms online can simplify the process of managing your annuity loan applications. This guide provides clear instructions on how to effectively complete the form, ensuring all necessary information is accurately documented.

Follow the steps to successfully complete your Brighthouse Financial forms.

- Press the ‘Get Form’ button to access the annuity loan application and agreement form. This will open the document in an editable format.

- In Section 1, provide your account information. Fill in fields such as account number, first name, middle name, last name, and addresses. Ensure you include your Social Security or Tax ID number, along with your work and home phone numbers.

- Continue to Section 2, where you will specify the loan amount. You can either fill in the desired loan amount or select the option to request the maximum loan amount available from your annuity contract.

- Move on to Section 3 to indicate the loan duration. Choose either option A or B based on your intended use of the loan proceeds and the desired repayment period.

- In Section 4, provide details about any outstanding loans from previous plans. List the company name, contract number, current vested balance, current loan balance, and the highest loan balance during the past year.

- Section 5 requires your acknowledgment and must be signed. Confirm that you understand the loan terms and regulations regarding federal income tax.

- If applicable, complete Section 6 regarding spousal consent for ERISA plans. Ensure that any necessary signatures are obtained.

- Submit the completed form as per Section 7 instructions. Follow the guidelines for mailing or faxing the document to Brighthouse Financial, ensuring to keep a copy for your records.

Complete your Brighthouse Financial forms online today to ensure a smooth processing experience.

Established by MetLife in 2017, Brighthouse Financial sells life insurance and annuities to individuals. In contrast, MetLife focuses primarily on employee benefits. You can only purchase a policy from Brighthouse Financial with the help of a financial professional, such as an advisor.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.