Loading

Get Travel Allowance Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Travel Allowance Form online

Completing the Travel Allowance Form online can streamline the process of claiming travel expenses. This guide provides clear instructions to help users fill out the form accurately and efficiently.

Follow the steps to complete the Travel Allowance Form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

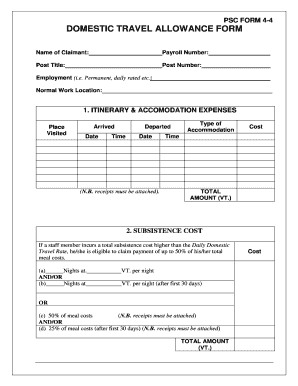

- Fill in your personal details in the Claimant section, including your name, payroll number, post title, post number, type of employment, and normal work location.

- In the Itinerary & Accommodation Expenses section, list each place visited along with the corresponding arrival date, departure time, departure date, type of accommodation, and cost. Ensure to attach receipts for these expenses to support your claim.

- For Subsistence Cost, indicate the number of nights at different locations and provide the relevant meal cost details. You can claim up to 50% of your total meal costs, including any applicable percentages after 30 days. Remember to attach corresponding receipts.

- Under Travel Expenses, fill in the date, the locations from where you are traveling, the destination, the method of transport, receipt number, and the associated cost for each travel segment.

- After completing all sections, certify the total sum incurred and the amount entitled for reimbursement, confirming the accuracy of your claims with your signature and date.

- Have your head of department sign the form and print their name along with the date to validate your claim.

- Once all sections are thoroughly filled out, review the information for accuracy, and then save your changes. You can download, print, or share the form as needed.

Submit your Travel Allowance Form online today for efficient processing of your reimbursement.

Related links form

You can deduct business travel expenses when you are away from both your home and the location of your main place of business (tax home). Deductible expenses include transportation, baggage fees, car rentals, taxis and shuttles, lodging, tips, and fees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.