Loading

Get Form 8867

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8867 online

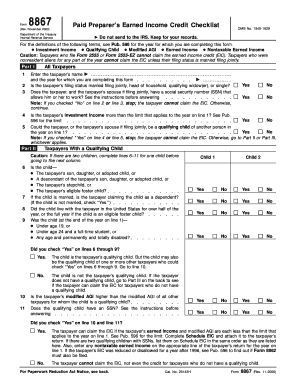

Filling out Form 8867 is essential for paid preparers to ensure they meet the due diligence requirements associated with the earned income credit (EIC). This guide provides a comprehensive, step-by-step process on how to complete the form online, catering to users of all experience levels.

Follow the steps to complete Form 8867 successfully.

- Press the ‘Get Form’ button to obtain Form 8867 and open it in the online editor.

- Begin by entering the taxpayer's name and the year for which you are completing the form. Ensure the information is accurate.

- Identify the taxpayer's filing status. Make sure to check if it is married filing jointly, head of household, qualifying widow(er), or single.

- Confirm that the taxpayer and their spouse, if applicable, have a social security number (SSN) that permits them to work. Review the instructions carefully before proceeding.

- If the taxpayer’s investment income exceeds the limits outlined for the year, stop here, as they cannot claim the EIC.

- Evaluate if the taxpayer or their spouse could be a qualifying child of another taxpayer. If 'Yes,' the taxpayer cannot claim the EIC.

- If there are qualifying children, provide necessary details for each child, including their relationship to the taxpayer, residency status, and age criteria.

- For each qualifying child, ensure you check if they have an SSN, as this is required.

- Complete the necessary sections for taxpayers without qualifying children, including residency and age requirements.

- Upon completion of the form, review all entries for accuracy. You may then save your changes, download a copy, print the form, or share it as needed.

Complete your Form 8867 online today to ensure compliance with earned income credit requirements.

Related links form

Purpose of Form Paid preparers of federal income tax returns or claims for refund involving the EIC must meet due diligence requirements in determining the taxpayer's eligibility for, and the amount of, the EIC. Failure to do so could result in a $500 penalty for each failure.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.