Loading

Get Aml Questionnaire Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Aml Questionnaire Template online

Filling out the Aml Questionnaire Template is an essential step in ensuring compliance with anti-money laundering regulations. This guide will provide users with clear, step-by-step instructions to efficiently complete this important document online.

Follow the steps to complete the Aml Questionnaire Template online

- Click ‘Get Form’ button to obtain the Aml Questionnaire Template and open it in your preferred online editor.

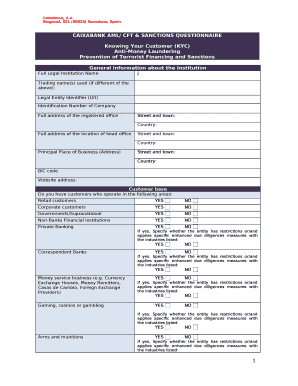

- Begin with the general information about the institution. Fill in the full legal institution name, trading name(s), and the legal entity identifier (LEI). Ensure the identification number of the company and full addresses are accurately provided.

- In the customer base section, indicate whether your institution has retail customers, corporate customers, governments, and various other customer types by selecting 'Yes' or 'No'. If you respond 'Yes', specify if there are restrictions in place or enhanced due diligence measures applied.

- Provide details regarding the customer locations, especially if more than 10% of your customers are from different countries. List the top three country locations as required.

- Proceed to the type of products and services offered. Check all applicable banking services, ensuring that each service listed matches your institution’s offerings.

- Complete the regulatory status section by indicating if your institution is licensed. If so, provide the name of the regulatory body, the license number, and any applicable restrictions.

- Shareholder structure requires you to specify the legal form and ownership of the institution, indicating if it is state-owned or private. If public, provide the stock exchange details.

- In the section regarding beneficial ownership, list details of any individuals who control or own 10% or more of the institution’s shares. Provide complete names, dates of birth, and nationalities.

- For AML policies, confirm the presence of compliance programs and provide details on training for relevant employees regarding anti-money laundering, financing of terrorism, and sanctions.

- After completing all sections and reviewing your answers for accuracy, proceed to save changes, download, print, or share the completed form as required.

Complete your documents online today to ensure compliance and enhance your operational integrity.

by Practical Law Business Crime and Investigations. This checklist summarises good practices in managing anti-money laundering (AML) compliance for firms and other organisations, including due diligence, risk assessment, policies and procedures and the role of the Money Laundering Reporting Officer (MLRO).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.