Get Flagship Credit Acceptance Guarantee Of Title 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Flagship Credit Acceptance Guarantee of Title online

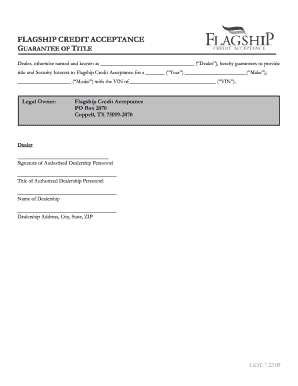

Filling out the Flagship Credit Acceptance Guarantee of Title online is a straightforward process that ensures proper documentation of title and security interests for vehicles. This guide will walk you through each section and field, providing clear instructions for users of all experience levels.

Follow the steps to complete the form accurately.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

- Locate the section titled 'Dealer' and provide the name of the dealership in the designated space.

- In the following fields, specify the details of the vehicle you are guaranteeing. Enter the year in the appropriate area denoted as 'Year', followed by the make and model of the vehicle.

- Next, input the Vehicle Identification Number (VIN) in the specified section for accurate documentation.

- Fill in the legal owner’s information. This will usually be 'Flagship Credit Acceptance', followed by their postal address: PO Box 2070, Coppell, TX 75019-2070.

- Ensure that an authorized personnel from the dealership signs the document, providing their full name, title, and dealership information, including address and ZIP code.

- Once all sections are completed, review the form for accuracy, then save your changes. You may then choose to download, print, or share the completed form as needed.

Complete your documents online for efficient and secure processing.

To speak with someone at Flagship Credit Acceptance, you can contact their customer service directly through their official website or customer support line. This can provide you with the assistance you need related to your loans and any questions about the Flagship Credit Acceptance Guarantee of Title. Having direct communication with a representative can often clarify concerns you may have.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.