Loading

Get Rev 419

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rev 419 online

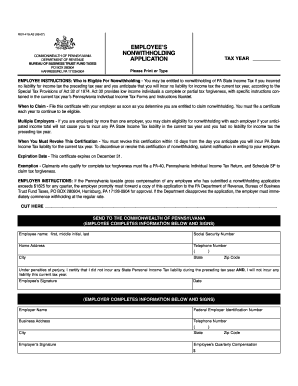

The Rev 419 form is essential for employees in Pennsylvania who seek nonwithholding of state income tax. This guide provides clear, step-by-step instructions on how to accurately fill out this form online, ensuring that you comply with state regulations.

Follow the steps to complete the Rev 419 form online

- Press the ‘Get Form’ button to access the Rev 419 form and open it in your preferred online editor.

- Provide your name in the space designated as 'Employee name: first, middle initial, last'. Ensure that you enter this information accurately to avoid any processing issues.

- Fill in your Social Security Number in the required field. Double-check the number for accuracy to prevent any complications.

- Enter your home address, including the street, city, state, and zip code. This information is critical for identification purposes.

- Provide your telephone number in the format requested, ensuring you include the correct area code.

- Review the statement regarding tax liability and certify that you did not incur any state personal income tax liability during the preceding tax year and that you anticipate not incurring any liability this current tax year. This statement must be acknowledged.

- Sign and date the form in the designated areas to certify the information provided is true and complete.

- If applicable, proceed to fill out the employer's section with the name, Federal Employer Identification Number, business address, and phone number.

- Finally, input the employee’s quarterly compensation amount in the designated space and ensure that the employer signs and dates the form as well.

- Once all fields are completed, review the entire form for accuracy. You may then save the changes, download a copy, print it, or share it as necessary.

Complete the Rev 419 form online today to ensure compliance and maximize your eligibility for nonwithholding.

What Does Filing Exempt on a W-4 Mean? When you file as exempt from withholding with your employer for federal tax withholding, you don't make any federal income tax payments during the year. (A taxpayer is still subject to FICA tax.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.