Loading

Get Us Bank Underwriting C2 2002-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the US Bank Underwriting C2 online

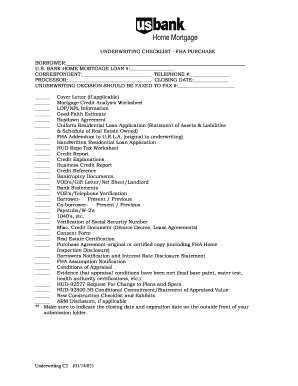

Filling out the US Bank Underwriting C2 online is a crucial step in the mortgage process. This guide will provide comprehensive instructions to help you successfully complete the form and submit it efficiently.

Follow the steps to accurately complete your underwriting checklist

- Click ‘Get Form’ button to obtain the document and access it for completion.

- Begin by providing the borrower's information, including the U.S. Bank home mortgage loan number, correspondent name, and telephone number. Ensure all details are accurate for effective processing.

- Next, fill in the processor's name and the preferred closing date, which is essential for scheduling purposes.

- Specify the fax number for the underwriting decision to ensure prompt communication. It is important to verify that the number is correct to avoid delays.

- Review the checklist of required documents to ensure all necessary paperwork is gathered. Each item listed, from the mortgage credit analysis worksheet to the purchase agreement, must be accounted for.

- If applicable, attach any cover letters and include specific information related to the FHA addendum or handwritten applications as needed based on your situation.

- Once all sections are completed and verified, you can save your changes, download the completed form for your records, print it for physical submission, or share it via fax or email as required.

Complete your documentation online now for a smoother mortgage process.

The 4 C's of mortgage underwriting include Capacity, Credit, Collateral, and Capital, all essential for assessing a borrower's ability to repay. In US Bank Underwriting C2, these factors help underwriters analyze risk and make informed decisions. By ensuring that all four components align, lenders can offer more reliable and secure mortgage options.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.