Get Joint Borrower: You Are Being Asked To Provide The Following Information To Be Considered As A 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the JOINT BORROWER: You Are Being Asked To Provide The Following Information To Be Considered As A online

Filling out the JOINT BORROWER application is an essential step in the credit process. This guide will provide you with clear instructions on how to successfully complete the form online, ensuring that you provide all required information accurately.

Follow the steps to complete your JOINT BORROWER application online.

- Click the ‘Get Form’ button to access the JOINT BORROWER application. This will allow you to open the form in your preferred editing tool.

- Begin by entering the primary borrower’s name and the loan product applied for. Ensure that this information is accurate, as it establishes the basis for your application.

- Next, provide the loan amount you are applying for. This should reflect the actual financial amount discussed between you and the primary borrower.

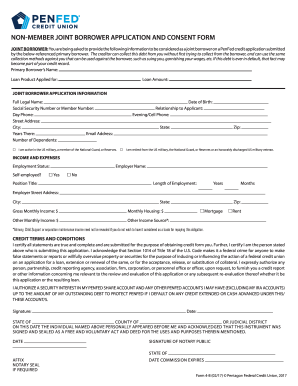

- In the JOINT BORROWER APPLICATION INFORMATION section, fill in your full legal name, Social Security Number or Member Number, day phone, street address, city, state, and zip code. Make sure these details are accurate and match your legal documentation.

- Indicate the number of dependents you have, your date of birth, and your relationship to the applicant. This section helps provide context for your application.

- Fill in your employment status. If self-employed, indicate so. Otherwise, provide your employer's name, position title, length of employment (in years and months), and employer's street address, city, state, and zip code.

- Enter your gross monthly income and any other monthly income you may have. If applicable, list the source of other income, noting that income from alimony, child support, or separation maintenance can be omitted if you choose.

- In the CREDIT TERMS AND CONDITIONS section, read the certification statement thoroughly. Acknowledge that all statements provided are true and complete, and authorize the creditor to obtain relevant information about your credit.

- Provide your signature and the date to certify your application. If required, have your signature notarized by a public notary, ensuring all details are completed accordingly.

- Finally, check your completed application for accuracy. Once you are satisfied, save your changes, and be sure to download, print, or share the form as needed.

Complete your JOINT BORROWER application online today for a smoother credit process.

A notice of error must clearly identify the borrower, the specific error in question, and a detailed description of the issue at hand. You should also include any relevant account information and supporting documents, as this aids in quicker resolution. Remember, as a joint borrower, presenting your case clearly can impact how your issue is addressed. Consider using templates from USLegalForms to streamline this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.