Loading

Get Umb I1150037 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UMB i1150037 online

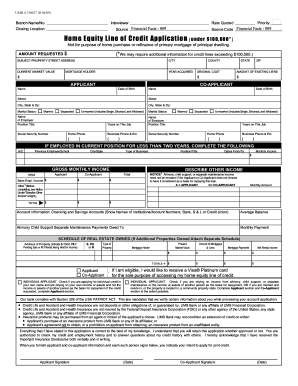

Filling out the UMB i1150037 form for a home equity line of credit can seem daunting, but with clear instructions, you can complete it with confidence. This guide will walk you through each section of the form, ensuring that you provide all necessary information accurately and efficiently.

Follow the steps to successfully complete the UMB i1150037 form.

- Click the ‘Get Form’ button to obtain the online version of the UMB i1150037 and open it for editing.

- Enter the branch name and number at the top of the form. Make sure this information is accurate as it helps identify your application.

- Fill in the interviewer’s name and the rate quoted in the respective fields. This ensures all communications are properly monitored.

- Provide the priority level and source code financial facts as requested. These help in classifying the application for processing purposes.

- Indicate the closing location for the application, which is necessary for logistical purposes.

- In the section for the home equity line of credit application, clearly state the amount requested. Note that additional information may be needed for amounts exceeding $100,000.

- Input the subject property street address, city, current market value, year acquired, mortgage holder, county, state, and ZIP code accurately. This section establishes details about the property being financed.

- Enter the original cost and amount of existing liens on the property; this information helps in assessing your equity.

- Complete the applicant and co-applicant sections with full names, dates of birth, addresses, marital status, employment details, and social security numbers for both parties.

- If either applicant has been employed for less than two years, provide details of previous employment or education as requested.

- Detail the gross monthly income for the applicant and co-applicant, breaking down any additional income or support that can be used in the application.

- List account information, including types of checking and savings accounts, their average balances, and any associated financial obligations.

- If applicable, include a schedule of real estate owned. Ensure that you accurately portray the type of property and its financial details.

- Review the options concerning insurance products. Indicate if you are applying for individual credit or relying on co-applicant income.

- Sign the form along with the co-applicant, including dates. Ensure both parties have provided their handwritten signatures to validate the application.

- Finally, save your progress, and download or print the completed form for your records. Alternatively, you can share it with the relevant parties for submission.

Complete your UMB i1150037 form online today to take the next step towards accessing your home equity!

The UMB Bank routing number for HSA accounts is 101205681. This number enables you to conduct transactions efficiently, such as transfers or payments. Keeping this routing number in mind can help you manage your HSA effectively, especially when connected to UMB i1150037.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.