Loading

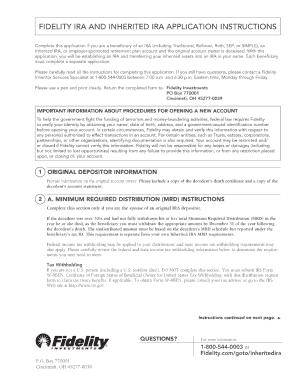

Get Oh Fidelity Ira & Inherited Ira App

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH Fidelity IRA & Inherited IRA App online

Filling out the OH Fidelity IRA & Inherited IRA App online is a crucial step for individuals looking to manage their retirement accounts effectively. This guide provides comprehensive instructions to help users navigate the application process with ease and confidence.

Follow the steps to complete your application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the designated fields, including your name, address, and date of birth. Ensure that all information is accurate and up-to-date.

- Next, provide details about your financial situation. This may include your current income, employment status, and any existing financial accounts related to your IRA.

- If you are applying for an inherited IRA, include the necessary information regarding the deceased individual, such as their name and relationship to you.

- Review your application thoroughly to confirm that all sections are filled out correctly. Double-check for any possible errors or omissions.

- Once satisfied with your entries, you may then save your changes, download a copy of the form for your records, print it for immediate submission, or share it as needed.

Start completing your OH Fidelity IRA & Inherited IRA App online today.

Yes, you can add a beneficiary to your account online with most financial institutions, including Fidelity. Simply access your account settings, locate the beneficiary section, and input the necessary details. Using the OH Fidelity IRA & Inherited IRA App streamlines this process, making it easy to ensure your loved ones are protected.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.