Loading

Get Department Of Revenue Compliance Support Unit Hartford Ct Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Department Of Revenue Compliance Support Unit Hartford Ct Form online

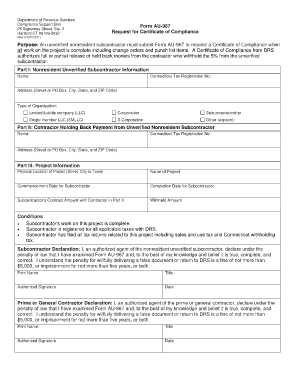

This guide provides clear instructions on how to complete the Department Of Revenue Compliance Support Unit Hartford Ct Form AU-967, which is essential for unverified nonresident subcontractors requesting a Certificate of Compliance. Following these steps will ensure that you provide all necessary information accurately and efficiently.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part I by entering the nonresident unverified subcontractor information. Provide the name, Connecticut Tax Registration Number, and address including the street, city, state, and ZIP code. Choose the appropriate type of organization from the given options such as limited liability company (LLC), corporation, sole proprietorship, single member LLC (SMLLC), S corporation, or other. If you select 'Other', you should briefly explain your organization type.

- Proceed to Part II where you need to fill in the contractor information. Enter the contractor's name, Connecticut Tax Registration Number, and address details including street, city, state, and ZIP code.

- Move on to Part III by providing the project information. Indicate the physical location of the project, the name of the project, and the dates for commencement and completion of the subcontractor's work.

- In this section, also include the subcontractor’s contract amount with the contractor listed in Part II and the amount that was withheld.

- Review the conditions that must be met. Confirm that the subcontractor's work on the project is complete, that they are registered for all applicable taxes with DRS, and that all relevant tax returns have been filed.

- Complete the subcontractor declaration by having an authorized agent print their name, title, provide their signature, and date the form.

- Finally, the prime or general contractor must also fill out their declaration by providing the required information similar to the previous step, ensuring both declarations are completed accurately.

- Once all sections are filled out correctly, save the changes. You may also download, print, or share the completed form as needed.

Take action now by filling out the form online to ensure compliance.

HOW TO OBTAIN CONNECTICUT TAX FORMS Connecticut state tax forms can be downloaded at the Department of Revenue Services (DRS) website: .ct.gov/drs/ Connecticut tax forms and publications are available at any DRS offices, during tax filing season.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.