Loading

Get Sro 660 I 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SRO 660 I 2007 online

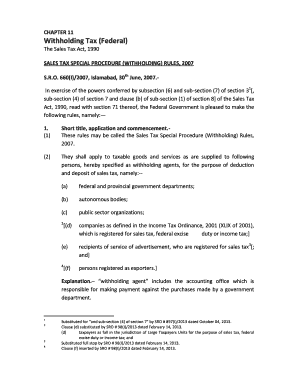

This guide provides a clear and concise approach to filling out the SRO 660 I 2007 form online. It aims to assist users of all experience levels in effectively completing this required document for withholding tax management.

Follow the steps to complete the SRO 660 I 2007 form online.

- Click the ‘Get Form’ button to access the SRO 660 I 2007 form and open it in the editor.

- Fill in the withholding agent's name and address in the designated fields. Ensure that all details are accurate and up to date.

- Specify the month and year for which you are filing the return. This helps in tracking and processing your submission.

- Enter your National Tax Number (NTN) or Free Tax Number (FTN) in the appropriate space. This is crucial for identification and compliance.

- Detail all sales tax deducted during the month. List each supplier's name, their NTN, the number of invoices, total sales tax charged, and the amount of sales tax deducted for each entry.

- Add up the total sales tax withheld during the month and enter this figure in the designated field.

- Review the information carefully to ensure accuracy and completeness before finalizing the form.

- Sign the form, provide the date, and affix your stamp if applicable. Your signature verifies the correctness of the information provided.

- Save the changes, then choose to download or print the completed form for your records. You may also share it electronically as required.

Complete your SRO 660 I 2007 form online today to ensure compliance with tax regulations.

Liability to Pay the Tax The liability to pay the sales tax in case of goods being supplied lies upon the consumer whereas the liability to pay the sales tax of imports lies upon the importer ing to section 3 of the Sales Act 1990.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.