Loading

Get Form 4509

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4509 online

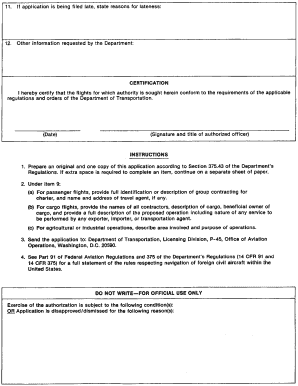

Filling out the Form 4509 online can be a straightforward process if you follow the right steps. This guide will walk you through each section of the form to ensure you complete it accurately and efficiently.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to obtain the form and open it in your chosen editor.

- Begin filling out the form by entering your personal information in the designated fields. Be sure to include your full name, address, and contact information as required.

- Proceed to the next section, where you will need to provide detailed information about the purpose of the form. Carefully read the instructions for each field to ensure that you supply accurate information.

- If the form requires additional documentation or verification, be prepared to upload or provide these materials as specified. Follow the prompts to ensure successful submission.

- After you have filled in all required sections, review your entries for accuracy. Make any necessary corrections to your responses.

- Once you are satisfied with the information provided, save your changes. You can then download a copy, print it out, or share it as needed.

Start filling out your Form 4509 online today to streamline your documentation process.

SBA requires you to complete the IRS Form 4506-T as a part of your disaster loan application submission. The form authorizes the IRS to provide federal income tax information directly to SBA. Although the form is available online, it cannot be transmitted electronically.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.