Loading

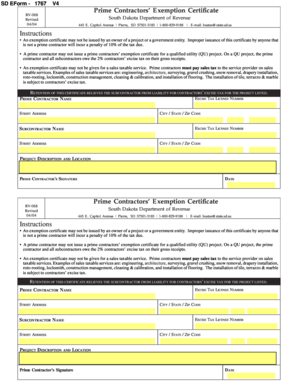

Get Prime Contractors Exemption Certificate - Multiple - State Sd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Prime Contractors Exemption Certificate - Multiple - State Sd online

Filling out the Prime Contractors Exemption Certificate - Multiple - State Sd online can streamline your documentation process and ensure compliance with state regulations. This guide provides clear, step-by-step instructions for each section of the form to assist users at all experience levels.

Follow the steps to complete the Prime Contractors Exemption Certificate online.

- Click ‘Get Form’ button to access the Prime Contractors Exemption Certificate and open it in your chosen text editor.

- Locate the ‘Excise tax license number’ field and enter the contractor's excise tax license number associated with your business.

- In the ‘Prime contractor name’ field, input the legal name of the prime contractor responsible for the project.

- Provide the street address of the prime contractor in the respective address field.

- Fill in the city, state, and ZIP code where the prime contractor operates.

- Next, find the second ‘Excise tax license number’ field and enter the relevant tax license number for the subcontractor.

- Input the ‘Subcontractor name’ in the designated field, ensuring the name used is the legal business name.

- Enter the street address for the subcontractor in the appropriate space.

- Detail the ‘Project description,’ clearly outlining the nature of the project being undertaken.

- Input the city, state, and ZIP code for the project's location.

- Lastly, the prime contractor must sign in the specified space and date the certificate to validate it.

- After completing the form, review all entries for accuracy, then save your changes, and you may choose to download, print, or share the completed certificate.

Complete your Prime Contractors Exemption Certificate online today for seamless processing.

Related links form

The seller or lessor must retain this certificate for at least four years from the date of the exempt sale to which the certificate applies. IMPORTANT: DO NOT RETURN THIS FORM TO THE PA DEPARTMENT OF REVENUE. 4.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.