Loading

Get Print Irs Form 941

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Print Irs Form 941 online

Filling out the Print Irs Form 941 online can initially seem challenging. This guide is designed to provide clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to effectively complete the Print Irs Form 941

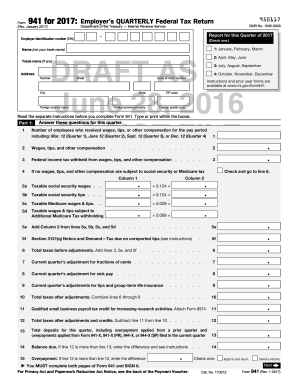

- Press the ‘Get Form’ button to acquire the form and open it in your selected digital platform.

- Begin by entering your employer identification number (EIN) in the designated field. This number is crucial for tax processing and should be accurate.

- State the name of your business (not your trade name) followed by your trade name if applicable, along with your business address including street, suite or room number, city, state, ZIP code, and any required foreign information.

- In Part 1 of the form, provide the total number of employees who received wages, tips, or other compensation during the relevant pay periods.

- Fill in the total wages, tips, and other compensation paid to your employees in the respective field.

- Record the amount of federal income tax withheld from wages or tips in the corresponding field.

- Complete the sections regarding taxable social security wages and any adjustments necessary for your tax liabilities.

- Provide information on total taxes before and after any adjustments, ensuring to check each calculation for accuracy.

- Indicate your deposit schedule and make sure to fill out the relevant sections pertaining to your business operations.

- Conclude your form by providing any required signatures, along with the date and title, ensuring you have completed both pages of Form 941.

- Once you have thoroughly filled out the form, save your changes. You can then download the document for your records, print it, or share it as needed.

Start completing your Print Irs Form 941 online today for straightforward filing.

Step 1: In the main Menu Bar in your QuickBooks account, Choose the Reports tab seen on the left side and Click it. Step 2: Now shift to the tab that says All Reports. Step 3: Choose the Payroll category from the given report options.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.