Loading

Get Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check - West Virginia

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check - West Virginia online

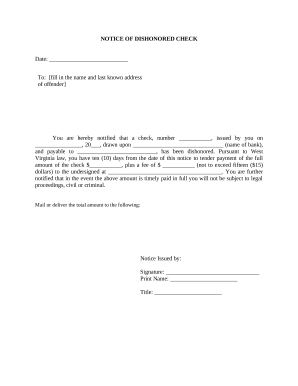

Filling out the Notice Of Dishonored Check in West Virginia is essential for notifying individuals about a check that has not been honored. This guide provides clear, step-by-step instructions to help you complete this document accurately and effectively.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the date at the top of the form. Ensure you use the correct current date to maintain clarity in communication.

- Fill in the name and last known address of the person who issued the dishonored check in the designated section. Accurate contact information is crucial for effective notification.

- Enter the check number in the specified field. This number helps in identifying the specific check that was dishonored.

- Record the date the check was issued. This date should reflect when the individual wrote the check to avoid any disputes regarding timelines.

- Indicate the name of the bank associated with the account on which the check was drawn. This information is essential for clarity and follow-up.

- Next, enter the payee’s name, that is, the person or entity to whom the check was payable, in the provided space.

- Specify the total amount of the check in the corresponding field. Make sure this amount matches the value on the dishonored check.

- Input any applicable fee amount not exceeding fifteen dollars in the next section. This fee depends on West Virginia law regarding dishonored checks.

- Provide the address where the full payment should be sent, ensuring it is clear and accurate.

- Finally, the issuer should sign the document and print their name and title in the designated areas to authenticate the notice.

- Once you have filled out all sections, save your changes. You can then download, print, or share the completed form as necessary.

Complete your documents online now for a streamlined process.

When you write a check and there's not enough funds in your account when it's presented, this is considered non-sufficient funds (NSF). When a check is returned due to NSF, it's returned to the payee that deposited the check, at their bank. This allows them to redeposit the check at a later time, if available.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.