Loading

Get 1604e Form Download

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1604e Form Download online

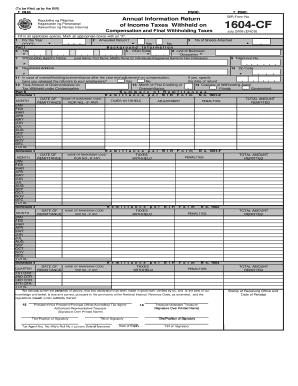

This guide provides clear instructions on how to complete the 1604e Form Download online. The 1604e Form is essential for employers and withholding agents to report taxes withheld from employee compensation accurately.

Follow the steps to effectively fill out the 1604e Form Download.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the year for which you are reporting in Box 1. Ensure this reflects the correct calendar year.

- Indicate if this is an amended return by selecting 'Yes' or 'No' in Box 2.

- Specify the number of sheets attached in Box 3. This ensures proper documentation of your filings.

- Complete Part I by entering background information such as Taxpayer Identification Number (TIN) in Box 4, Registered District Office (RDO) code in Box 5, business line or occupation in Box 6, and the withholding agent’s contact information in Boxes 7 to 10.

- Answer the question in Box 11 regarding refunds for overwithholding/overremittance and indicate the refund date if applicable.

- Provide the total amount of overremittance in Box 12, and state the month of first crediting under Box 13.

- Choose the category of withholding agent in Box 14 by selecting either 'Private' or 'Government.'

- In Part II, summarize your remittances. Fill out the respective schedules for each BIR Form associated with your remittances (Schedules 1 to 4). Record the details such as bank names, amounts of taxes withheld, and adjustment penalties month by month.

- Part III accounts for the alphabetical list of employees/payees. Complete the details in all applicable schedules (Schedules 5 to 7) to reflect the employees subject to final withholding tax.

- Finally, ensure all required signatures are in place, including verification by the signatory in the designated fields. Include the TIN of the signatory for validation.

- Review all entries for accuracy and completeness, then save any changes. You can download, print, or share the final form as needed.

Start filling out your 1604e Form Download online now to ensure accurate tax reporting.

Form 1601EQ – Quarterly Remittance of Creditable Income Tax Withheld. This is what you file every January, April, July, and October. Each form covers the quarter immediately preceding it. It's basically similar to Form 0619E but with more details as to what you withheld.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.