Loading

Get Tiaa Spousal Support Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tiaa Spousal Support Forms online

Filling out the Tiaa Spousal Support Forms online can be straightforward if approached systematically. This guide will provide you with detailed, step-by-step instructions on how to complete each section of the form accurately and efficiently.

Follow the steps to successfully complete the forms

- Click ‘Get Form’ button to access the Tiaa Spousal Support Forms and open it for editing.

- Begin with the personal information section. Fill in your full name, state of legal residence, contact phone number, and taxpayer identification number. Ensure all information is entered in all capital letters using black or dark blue ink.

- Enter the plan information. You will need to include your TIAA and CREF numbers, as well as the plan name and number. If you are unsure of these numbers, contact support for assistance.

- Indicate whether the contract was issued due to a divorce by selecting 'Yes' or 'No'. Proceed based on your answer to step two.

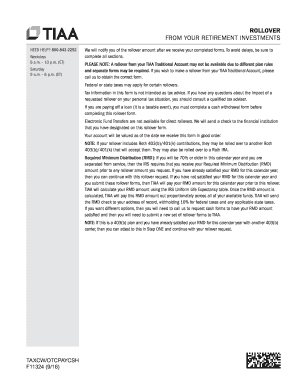

- In the rollover amount section, decide if you want to roll over the entire amount or just a portion. Select the appropriate option and specify the amount clearly.

- If you choose to roll over only a portion, complete the specific funds section, indicating either the dollar amount or percentage to roll over. Ensure that the figures you provide are whole numbers.

- Proceed to state your new allocations if you are rolling over to a TIAA-CREF account. Follow the instructions to indicate desired investment fund percentages or amounts.

- If you are rolling over to another investment company, fill in the contact information of the receiving company as required.

- Review the tax withholding options for Roth IRA rollovers and select your preferences regarding federal taxes.

- Sign and date the form where indicated. Make sure you understand the implications of your rollover, including any tax consequences.

- Return the completed forms package to the designated Tiaa-Cref address for processing. If your amount is less than $50,000, you may fax your form instead.

Start completing your Tiaa Spousal Support Forms online today to ensure a smooth and timely process.

If you die first, your annuity partner's income is reduced to 75% of the original amount. Your income isn't reduced if your annuity partner dies first. You will receive income as long as you live. Income continues for the full amount following the death of either you or your annuity partner.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.