Loading

Get Da185 Checklist

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Da185 Checklist online

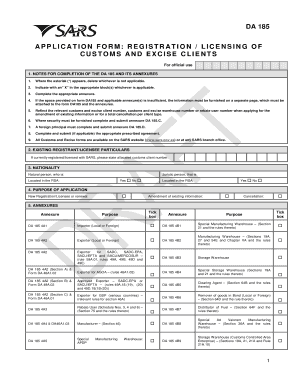

Filling out the Da185 Checklist online is a straightforward process designed to assist individuals and businesses in registering with customs and excise authorities. This guide provides a step-by-step approach to help users navigate through the various sections of the form effectively.

Follow the steps to fill out the Da185 Checklist online

- Click the ‘Get Form’ button to obtain the checklist and open it in your preferred editor.

- Begin by filling in the details for the existing registrant or licensee particulars if applicable. Include the customs client number if currently registered.

- Indicate the nationality of the applicant, confirming whether they are a natural person or a juristic person, and their location in the RSA.

- Select the purpose of the application by choosing one of the options: new registration/license renewal, amendment of existing information, or cancellation.

- Complete the annexure section by ticking the relevant boxes corresponding to the purposes of your application as needed.

- Provide business or personal details, including the registered name, address, business contact information, and South African bank account details if applicable.

- Fill in any relevant SARS revenue identification numbers, such as VAT, PAYE, and UIF numbers.

- Specify the nature of the business and provide particulars for any sole proprietor, individual, directors, or partners involved.

- Indicate details regarding public officers or representatives associated with the business.

- Respond to the section regarding contraventions and other matters honestly, providing additional details if necessary on a separate page.

- Attach all required supporting documents as specified for either natural persons or juristic persons, ensuring they are not older than three months.

- Complete the declaration section, confirming the accuracy of the information provided, and ensure it's signed and dated.

- Once all information is filled out accurately, save changes, and you can download, print, or share the completed form.

Start completing the Da185 Checklist online today to ensure your customs and excise registration is accurate and timely.

They are used by customs officials to identify and assess tariffs and taxes on imported and exported goods. In South Africa, HS codes are used by the South African Revenue Service (SARS) to determine the correct duty and VAT for imported goods.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.