Loading

Get Form 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2002 online

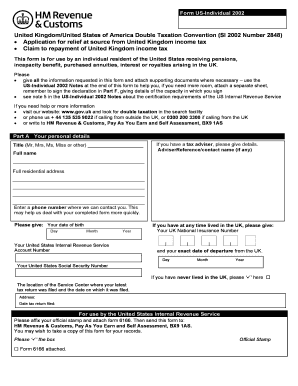

Filling out the Form 2002 online can be straightforward with the right guidance. This form is essential for individuals residing in the United States who are receiving UK-source income and are seeking relief from UK income tax.

Follow the steps to complete the Form 2002 online.

- Click 'Get Form' button to obtain the form and launch it in the online editor.

- In Part A, enter your personal details, including your full name, address, and contact information. If applicable, provide your tax adviser's details.

- In Part B, answer the questions by checking the appropriate boxes. Make sure to provide additional information if required.

- Proceed to Part C to apply for relief at source from UK income tax. Choose the relevant options based on your income type, such as pensions, annuities, interest, or royalties.

- Complete Part D if you have received payments with UK tax deducted, providing the necessary details about the income source and tax deducted.

- If you wish the repayment to go to someone else, complete Part E with the nominee's details.

- Lastly, sign the declaration in Part F, ensuring that all the information provided is accurate and complete.

- Once all sections are completed, you can save your changes, download the document, print it, or share it as needed.

Complete your Form 2002 online today for efficient processing of your tax relief application.

Although the average may change as more returns are processed, taxpayers are likely to see a lower refund due to a number of key tax credits returning to pre-pandemic amounts. The IRS expects more than 168 million individual tax returns for this tax season.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.