Loading

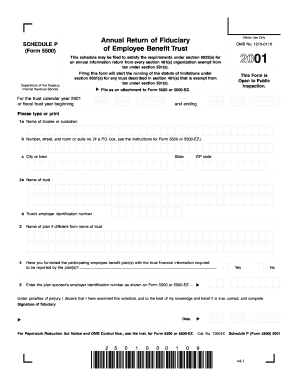

Get 2001 Form 5500 Schedule P. Annual Return Of Fiduciary Of Employee Benefit Trust - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2001 Form 5500 Schedule P. Annual Return Of Fiduciary Of Employee Benefit Trust - Irs online

Completing the 2001 Form 5500 Schedule P can be a straightforward process with the right guidance. This document helps fiduciaries comply with reporting requirements for employee benefit trusts by ensuring all necessary information is accurately submitted.

Follow the steps to successfully complete your form online.

- Press the ‘Get Form’ button to access the form and open it in your online editor.

- Fill in the trust's calendar year information or fiscal trust year. Specify the beginning and ending dates in the MM/DD/YYYY format.

- Enter the name of the trustee or custodian in Field 1a. Ensure that the name reflects the official entity managing the trust.

- Complete Field 1c with the city or town of the trustee's address.

- In Field 2a, input the official name of the trust. If the plan name differs from the trust name, include that in Field 2b with the trust's employer identification number.

- Respond to question 4 by answering whether you have provided participating employee benefit plans with the financial information required to be reported. Select 'Yes' or 'No.'

- Record the plan sponsor's employer identification number as indicated in Field 5 as shown on Form 5500 or 5500-EZ.

- Under penalties of perjury, read the declaration in Field 3, and confirm that the information is true, correct, and complete. Include the date of submission in the appropriate format.

- Finally, include the signature of the fiduciary and date it appropriately to complete the filing process. Review your entries for accuracy before submission.

- Save your changes, and download or print the completed form for your records. Share the form as necessary to comply with filing requirements.

Start filling out your documents online today to ensure timely and accurate submissions.

The Form 5500 is filed with the DOL and contains information about a 401(k) plan's financial condition, plan qualifications, and operation. The purpose of the form is to provide the IRS and DOL with information about the plan's operation and compliance with government regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.