Loading

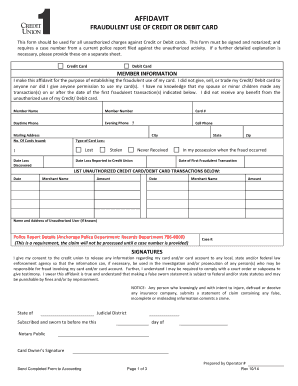

Get Affidavit Of Fraudulent Use Of A Credit Or Debit Carddoc - Cu1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Affidavit Of Fraudulent Use Of A Credit Or Debit Carddoc - Cu1 online

This guide provides a comprehensive overview of how to properly fill out the Affidavit Of Fraudulent Use Of A Credit Or Debit Carddoc - Cu1 online. The document is essential for reporting unauthorized charges and ensures that the necessary information is accurately provided.

Follow the steps to complete your affidavit online.

- Click ‘Get Form’ button to access the affidavit and load it for completion.

- Fill in your member information. This includes your full name, member number, and contact phone numbers for daytime and evening.

- Provide your mailing address, including street address, city, state, and zip code. Mention the number of cards issued to you.

- Indicate the specific card that has been lost or compromised by entering the card number and type.

- Document the date when you discovered the card loss, and specify if the card was lost, stolen, or never received.

- Include the date when you reported the loss to your credit union.

- State whether the card was in your possession when the fraudulent activity occurred.

- List the date of the first fraudulent transaction. Collect all relevant transaction details for the next section.

- Provide a detailed list of the unauthorized transactions. Include the date, merchant name, and amount for each transaction.

- If known, include the name and address of the unauthorized user.

- Record the police report case number related to the fraudulent activity, as this is a mandatory requirement.

- Read the consent section carefully and sign the document. You will also need to have the affidavit notarized.

- Once completed, save any changes you've made, and you can choose to download, print, or share the document as necessary.

Complete your affidavit online today to address any fraudulent use of your card.

Fraudsters might obtain your information through phishing or hacking, and some criminals sell card data online on the dark web. The thief doesn't need the physical card since online purchases only require that they know your name, account number and security code.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.