Loading

Get Ca 592 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ca 592 Instructions online

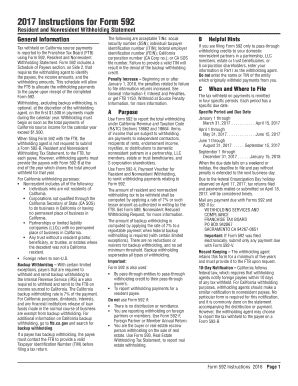

Filling out the Ca 592 form is essential for reporting California source income withholding. This guide provides clear and comprehensive instructions on how to complete the form online, ensuring you understand each section effectively.

Follow the steps to complete the Ca 592 form online:

- Press the ‘Get Form’ button to access the Ca 592 form and open it in your online editor.

- Begin by entering the tax year for which you are reporting withholding. Ensure it is the correct year corresponding to your records.

- Fill in your information as the withholding agent. Provide either your business name or individual name above the designated field and ensure to include your Taxpayer Identification Number (TIN). Select the appropriate box indicating your entity type.

- Complete Part II by checking the boxes that represent the type of income being withheld. Be thorough in identifying all applicable income types.

- For Part III, enter all necessary withholding amounts. Line 1 should reflect the total withholding, excluding backup withholding, while Line 2 captures the backup withholding totals. Add these figures in Line 3 to get the overall tax amount withheld.

- Fill out the Schedule of Payees section on Side 2. Provide detailed information for each payee, including their name, TIN, income amounts, and the withholding amounts.

- Review all entries for accuracy, ensuring that no fields are left blank and that all payees are accounted for. Correct any errors encountered.

- Once all fields are filled, save the document. You can then choose to download, print for your records, or share the form as needed.

Take action now and complete your Ca 592 form online!

However, withholding agents must provide payees with copies of Form 592‑B. For electronic filing, submit your file using the SWIFT process as outlined in FTB Pub. 923, SWIFT Guide for Resident, Nonresident, and Real Estate Withholding. For the required file format and record layout for electronic filing, get FTB Pub.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.