Loading

Get Authorization For Direct Deposit Of Annuity Payments

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the authorization for direct deposit of annuity payments online

Completing the authorization for direct deposit of annuity payments is a straightforward process. This guide will walk you through each step to ensure a successful submission, allowing you to securely and efficiently manage your payment preferences.

Follow the steps to complete your direct deposit authorization form.

- Click ‘Get Form’ button to obtain the form and access it in the editor.

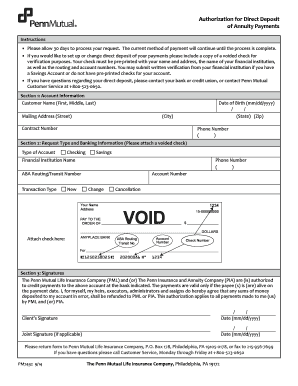

- Begin with Section 1: Account Information. Provide your full name (first, middle, last), date of birth in mm/dd/yyyy format, and your mailing address including street, city, state, and zip code. Additionally, include your contract number and phone number.

- Move to Section 2: Request Type and Banking Information. Indicate the type of account you are using (checking or savings) and provide the name of your financial institution along with their phone number. Enter the ABA routing/transit number and account number for your deposit.

- Attach a voided check for verification purposes, ensuring that it is pre-printed with your name, address, financial institution's name, and routing and account numbers. If you do not have a voided check, include written verification from your financial institution.

- In Section 3: Signatures, you will need to sign and date the form. If applicable, include a joint signature and date. This indicates your consent for the payments to be credited to the designated account.

- Finally, review the completed form for accuracy. Save your changes, then download or print the form for your records. Send the completed form to Penn Mutual Life Insurance Company as specified, either by mail or fax.

Begin completing your authorization for direct deposit of annuity payments online today.

Related links form

You'll need your new account number and the routing number of the financial institution, along with their name, address, and main phone number. 2. Fill out a direct deposit authorization form with your employer. This will allow them to make the switch between your old checking account and your new one.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.