Loading

Get Canada Rc59 E 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada RC59 E online

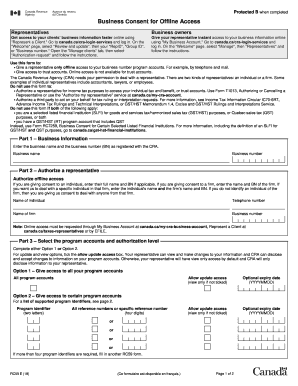

This guide provides a clear and user-friendly approach to completing the Canada RC59 E form online. By following these detailed steps, users will understand how to effectively authorize a representative for offline access to their business number program accounts.

Follow the steps to complete the Canada RC59 E form online.

- Press the ‘Get Form’ button to access the RC59 E form and open it for editing.

- In Part 1, enter the business name and the business number (BN) exactly as registered with the Canada Revenue Agency (CRA). This information is crucial for identifying your business.

- Move to Part 2 and authorize a representative for offline access. Provide the full name and BN of an individual or a firm. If applicable, specify the name of a particular individual within the firm and their contact telephone number.

- In Part 3, choose either Option 1 or Option 2 to determine the level of access your representative will have. For all program accounts, tick the box for allow update access and provide an optional expiry date if desired. If only certain accounts are to be accessed, complete the details under Option 2 for each program identifier.

- Proceed to Part 4 to certify the form. An individual with authority must sign here. The signer should check the appropriate box that describes their role (owner, partner, corporate director, etc.). Ensure the first name, last name, title, and telephone number are included, along with the date and signature.

- After completing all sections, save your changes, download the form, and then print or share it as necessary. Ensure to send the finalized document to your appropriate tax centre.

Take action now and complete your Canada RC59 E form online to ensure your representative has the access they need.

The CRA can send you texts in Canada, but only if you have opted into this form of communication. These texts may provide updates or alerts regarding your tax situation. Always confirm the authenticity of any message received, especially when dealing with sensitive information related to Canada RC59 E.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.