Loading

Get Form It 272 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-272 Instructions online

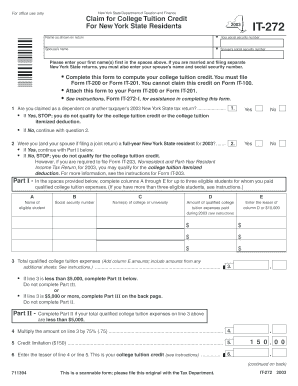

Filling out the Form IT-272 Instructions online is essential for New York State residents seeking to claim their college tuition credit. This guide will walk you through each step, ensuring that you understand how to complete the form accurately and efficiently.

Follow the steps to fill out the Form IT-272 Instructions online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Enter your name as it appears on your tax return in the designated field.

- Input your social security number in the required area.

- If applicable, provide your spouse’s name and social security number.

- Respond to the first question regarding whether you are claimed as a dependent on another taxpayer's return. If the answer is 'Yes', you do not qualify for the credit.

- Indicate if you and your spouse were full-year New York State residents. If 'Yes', proceed to Part I.

- For Part I, list the names of eligible students along with their social security numbers and the names of the colleges or universities they attended in the specified columns.

- Document the amount of qualified college tuition expenses paid during the relevant tax year in the corresponding field.

- Calculate the lesser amount from your total tuition paid or $10,000, and fill this in column E for each student.

- Sum up all values in column E to fill out the total qualified college tuition expenses.

- Depending on the total qualified expenses, determine whether to complete Part II or Part III based on the instructions.

- If applicable, follow the instructions outlined in Part IV regarding itemized deductions.

- Once all fields have been accurately completed, you can save, download, print, or share the form.

Start completing your Form IT-272 Instructions online to ensure you receive your credit.

An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return. If the credit reduces your tax to less than zero, you may get a refund. There are two education credits available: the American opportunity tax credit (AOTC) and the lifetime learning credit (LLC).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.