Loading

Get Client Tax Organizer - Cch Site Builder

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Client Tax Organizer - CCH Site Builder online

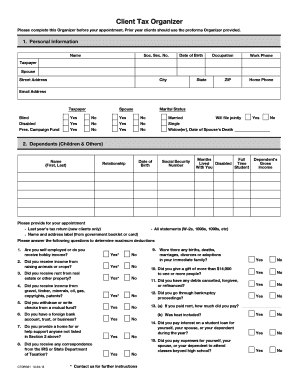

This guide provides a comprehensive overview of the Client Tax Organizer - CCH Site Builder, designed to assist users in accurately filling out the form online. Following these instructions will help ensure that you gather all necessary information prior to your appointment.

Follow the steps to complete your Client Tax Organizer effectively.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering your personal information, including your name, Social Security number, date of birth, occupation, and contact details. Make sure to indicate your marital status and whether you wish to contribute to a political campaign fund.

- Next, fill out the dependents section by listing the names, dates of birth, relationships, Social Security numbers, and any relevant income for each dependent. This will help determine eligibility for various tax credits and deductions.

- Proceed to answer the subsequent questions regarding income sources, such as self-employment, rental income, and any significant life events that could affect tax responsibilities. Each question is vital for maximizing deductions.

- Input information regarding wages, salaries, interest income, dividends, pensions, and other income sources. Attach relevant documents such as W-2s and 1099s, as needed.

- Continue by detailing any deductions or expenses you incurred throughout the year. This includes medical expenses, educational costs, and charitable contributions. Attach documentation where applicable.

- Review the business and travel-related expenses if applicable, including any job-related moving expenses, business mileage, and other deduction claims.

- Conclude the form by specifying your preferences for direct deposit of refunds, purchase of savings bonds, and signing the verification statement to affirm that all information provided is complete and accurate.

- Once you have filled out the entire form, ensure that you save changes, and then download, print, or share the completed form as necessary before your appointment.

Complete your Client Tax Organizer online today to ensure a smooth tax preparation process.

Related links form

Form 1040 is what individual taxpayers use to file their taxes with the IRS. The form determines if additional taxes are due or if the filer will receive a tax refund. Taxpayers must include personal information on Form 1040, such as name, address, Social Security number, and the number of dependents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.