Loading

Get 1099 Int Wells Fargo

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1099 Int Wells Fargo online

Filling out the 1099 Int form from Wells Fargo is an essential task for properly reporting your interest income. This guide provides a step-by-step approach to help you accurately complete the form online, ensuring that you understand each component involved.

Follow the steps to successfully complete the 1099 Int form online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Locate the section for your personal information at the top of the form. Here, enter your name, address, and taxpayer identification number (TIN). Make sure these details are accurate as they directly affect your tax filing.

- Next, identify the total interest income you received from Wells Fargo for the tax year in question. This total is usually provided on your 1099 Int form and should match your records.

- In the appropriate field for tax-exempt interest, include any amounts listed under box 8 of your form if applicable. This represents the income you may not owe federal tax on.

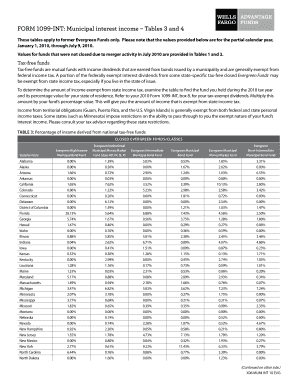

- For state tax-exempt interest, refer to the relevant state-specific table from your documentation. Use the percentage to calculate the exempt portion of your income based on your residence.

- Double-check all entries to verify their accuracy. Ensure that your name and TIN align with your official documents to avoid processing delays.

- Once satisfied with the entries, you can choose to save changes, download for your records, print a copy, or share the completed form, as needed.

Complete your 1099 Int filing online for a seamless tax experience.

Related links form

IRS reporting Once the IRS thinks that you owe additional tax on your unreported 1099 income, it will usually notify you and retroactively charge you penalties and interest beginning on the first day they think that you owed additional tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.