Loading

Get Ks Lpf 51-06 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS LPF 51-06 online

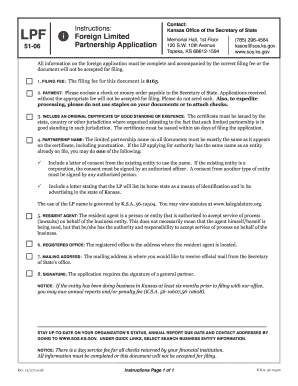

Filling out the KS LPF 51-06 form is an essential step for foreign limited partnerships wanting to operate in Kansas. This guide provides a clear, step-by-step process to help users complete the form accurately and efficiently.

Follow the steps to complete the KS LPF 51-06 form online.

- Click ‘Get Form’ button to access the KS LPF 51-06 application and display it in your browser.

- Enter the name of the limited partnership in the designated field. Ensure that this name exactly matches the name listed on the certificate of good standing.

- Indicate the state or country of organization where the limited partnership was originally formed.

- Provide the date of organization by filling in the month, day, and year in the appropriate fields.

- Specify the date the partnership began doing business in Kansas, using the format of month, day, and year.

- Complete the resident agent section by including the name and street address of the authorized individual or entity in Kansas. Note that P.O. box addresses are not acceptable.

- Fill in the mailing address where official correspondence from the Secretary of State’s office should be sent.

- Indicate the tax closing month for the partnership.

- Provide a full description of the business activities the partnership plans to conduct in Kansas.

- List the name and mailing address of each general partner. If necessary, include additional partners on a separate attachment.

- Consent that actions may be commenced through the Secretary of State if required, as outlined in the form.

- Indicate the effective date of the filing: upon filing or a future specified date.

- Have a general partner sign and date the form, affirming the accuracy of the information provided.

- Once completed, review all information for accuracy before saving changes, downloading, printing, or sharing the form as needed.

Get started with your application today and complete your KS LPF 51-06 form online.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To set up withholding, you need to determine how much you should withhold from your employees' wages based on Kansas tax regulations. The KS LPF 51-06 offers a framework for understanding these requirements. Leveraging US Legal Forms can aid you in collecting the necessary information and setting up your withholding accurately.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.