Loading

Get Ga Form 7 G 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA Form 7 G online

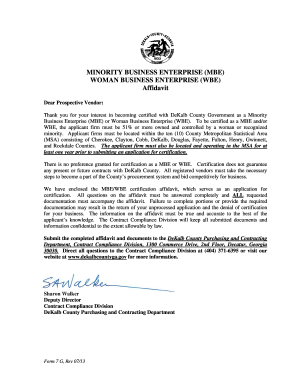

This guide provides clear instructions on how to fill out the GA Form 7 G online for certification as a Minority Business Enterprise (MBE) or Woman Business Enterprise (WBE). By following these steps, users can ensure their applications are completed accurately and efficiently.

Follow the steps to fill out the GA Form 7 G online

- Press the ‘Get Form’ button to access the GA Form 7 G and open it in the online editor.

- Begin with the 'Applicant Firm' section. Enter the name of the firm and the name of the owner. Indicate whether the owner is a U.S. citizen or a lawfully admitted permanent resident.

- Provide the principal place of business along with the mailing address. Ensure that the city, county, state, and zip code are filled in accurately.

- Include contact details, such as the telephone number, fax number, website, and email address.

- Select the type of ownership from the options provided — either Sole Proprietorship, Partnership, Limited Liability Partnership, Corporation, Limited Liability Company, or Joint Venture.

- Indicate whether you are applying for status as an MBE, WBE, or both by checking the appropriate boxes.

- Fill in the type of business operated, including Construction, Service, Manufacturer, or Supplier/Non-Manufacturer. Provide a brief description of your business to assist in categorizing it in the Certified Vendors List.

- Document the start date of the business and its location, and answer the questions related to current certifications and past participation in DeKalb County procurement.

- Complete the sections relevant to your business ownership type (Sole Proprietorship, Partnership, or Corporation), answering all questions fully.

- Sign and date the affidavit, ensuring that the information is true and accurate. Don't forget to have the document notarized.

- Attach all required documents as listed in Appendix A, ensuring completeness to avoid delays. Once everything is filled out, use the options available to save changes, download, print, or share the completed form.

Take the next step to certify your business by completing the GA Form 7 G online today!

Related links form

To accurately fill out your tax withholding form, include your identification details, such as your address and Social Security number. Specify your filing status and number of allowances on the GA Form 7 G. Double-check your entries to prevent issues with your withholding amounts and ensure everything is completed clearly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.