Loading

Get Form 1125 A

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1125 A online

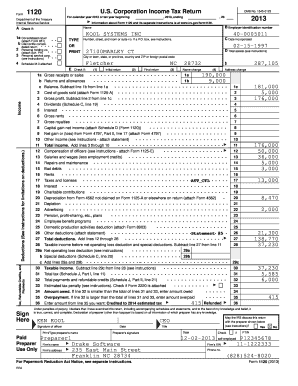

Filling out Form 1125 A is an essential step for accurately reporting your cost of goods sold. This guide will provide clear and concise instructions on completing the form online, ensuring all users, regardless of prior experience, can navigate the process with confidence.

Follow the steps to successfully complete the Form 1125 A online.

- Click ‘Get Form’ button to obtain the Form 1125 A and open it in the editor.

- Enter your employer identification number in the designated field. Ensure to double-check for accuracy.

- Fill in the name of your corporation as it appears on your tax return. This will help to maintain consistency.

- In the line for 'Purchases', input the total amount of goods purchased during the year. Be precise to minimize errors.

- Record the 'Cost of labor' in the appropriate section. This reflects the labor costs associated with producing your goods.

- Include any 'Additional section 263A costs' if applicable. These costs may include additional expenses related to inventory production.

- Report 'Other costs' related to your cost of goods sold, ensuring all relevant documents are attached as required.

- Calculate 'Total' costs by adding lines 1 through 5. Ensure the total is correct before proceeding.

- List the 'Inventory at end of year' and 'Inventory at beginning of year' values to finalize your calculations.

- Compute the 'Cost of goods sold' by subtracting the end inventory from the total calculated costs. Enter this amount as required.

- Finally, review all entries for accuracy, and once confirmed, save changes, download, print, or share the form as needed.

Complete your Form 1125 A online today to ensure your tax filing is accurate and timely.

Tax Form 1125 A is specifically designed for reporting income from trading activities. It outlines various components of your trading portfolio, allowing you to disclose income, expenses, and any gains or losses. Using Form 1125 A correctly can help minimize your tax liabilities and keep you in line with IRS guidelines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.