Loading

Get In Form 51766 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN Form 51766 online

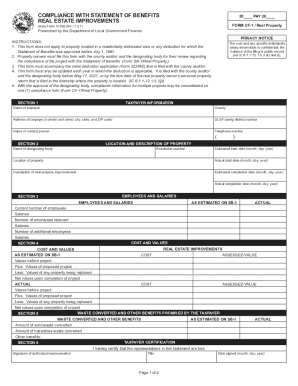

Completing the IN Form 51766 online is essential for property owners seeking compliance with their Statement of Benefits. This guide provides clear, step-by-step instructions on how to complete each part of the form to ensure accuracy and compliance.

Follow the steps to successfully complete the IN Form 51766.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out Section 1, which includes taxpayer information. Provide the name of the taxpayer, county, complete address including city, state, and ZIP code, DLGF taxing district number, name of contact person, and telephone number.

- Proceed to Section 2 for the property location and description. Enter the name of the designating body, resolution number, estimated start date, actual start date, location of the property, a detailed description of the real property improvements, estimated completion date, and actual completion date.

- In Section 3, provide information on employees and salaries. Fill in the current number of employees, their salaries, the number of retained employees, their salaries, along with the number of additional employees and their respective salaries.

- Move to Section 4 to report cost and value estimations. Fill in the values before the project, values of the proposed project, values of any property being replaced, and net values upon completion of the project. Repeat this for the actual values section as well.

- In Section 5, provide details about waste converted and other benefits. Input the amount of solid waste converted, hazardous waste converted, and list any other benefits.

- Conclude with Section 6 where the taxpayer certification is required. The authorized representative must sign, provide their title, and enter the date signed.

- Once you have completed all sections, review the form for any errors. You will then have the option to save changes, download, print, or share the form as needed.

Take the next step in your compliance process by completing the IN Form 51766 online today.

Real property abatement • A property tax deduction from the assessed valuation granted by the designating body for the construction of a new structure or a rehabilitation of property in an ERA.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.