Loading

Get Kyc Questionnaire Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kyc Questionnaire Template online

Completing the KYC Questionnaire Template online is a vital process for ensuring compliance with identification and anti-money laundering regulations. This guide will provide you with step-by-step instructions on how to accurately fill out the form, enhancing your understanding and ease of use.

Follow the steps to effectively complete the KYC Questionnaire Template.

- Press the ‘Get Form’ button to retrieve the KYC Questionnaire Template, opening it in your preferred online editor.

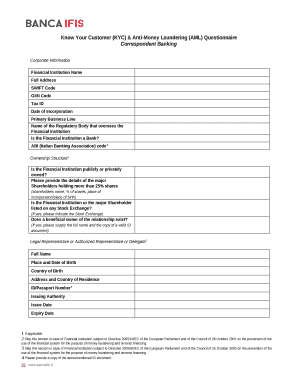

- Begin with the Correspondent Banking section. Enter the financial institution's name, full address, SWIFT code, GIIN code, tax ID, date of incorporation, and primary business line. Provide the name of the regulatory body overseeing the institution and specify if it is classified as a bank.

- In the ownership structure section, indicate whether the financial institution is publicly or privately owned. If applicable, detail the major shareholders holding more than 25% of shares, including their names, percentage of shares, and place of incorporation or place of birth.

- For the beneficial ownership question, respond if a beneficial owner exists, and provide the full name along with a copy of a valid ID document if applicable.

- Fill in the information for the legal representative or authorized representative. This includes their full name, place and date of birth, country of birth, address and country of residence, ID/passport number, issuing authority, issue date, and expiry date.

- Proceed to the AML Policies, Practices and Procedures section. Answer the questions regarding the company’s compliance with AML laws, if the compliance program requires board approval, and policies related to suspicious transactions and relationships with shell banks, among others.

- Continue to the Risk Assessment section. Indicate if the company has a risk-focused assessment of its customer base and details regarding enhanced due diligence for high-risk customers.

- Fill in the Know Your Customer, Due Diligence and Enhanced Due Diligence section by answering questions about customer identification processes, business activities, and procedures regarding high-risk clients.

- In the Transaction Monitoring and Reporting section, confirm if the company has policies for identifying and reporting suspicious transactions and if it screens customers against government lists.

- Lastly, address the AML Training section by indicating if the company provides relevant training to employees and agents, including how to retain training records.

- Complete the form by entering the contact person's full name, title, telephone, email address, and the date of completion. Don’t forget to sign the document before submitting.

- After reviewing all entries for accuracy, you can save changes, download a copy, print the form, or share it as necessary.

Complete your KYC Questionnaire Template online today to ensure compliance and streamline your onboarding process.

KYC Analyst Interview Questions Q1. I was asked the difference kinds of identification required to open a bank account. ... Q2. Full form of FATCA What is kyc Why for kyc Need of kyc Sanctioned countries. ... Q3. What is Politically Exposed Person. ... Q4. Tell me about yourself. ... Q5. What is corporate KYC. ... Q6. ... Q7. ... Q8.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.