Loading

Get 2020 Ct 200 V

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2020 Ct 200 V online

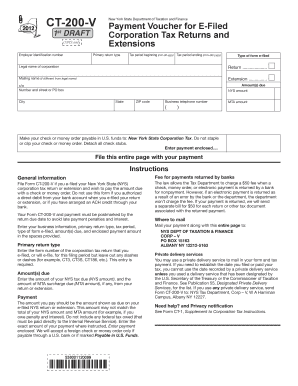

Filling out the 2020 Ct 200 V form online can streamline your tax payment process for e-filed corporation tax returns and extensions. This guide provides you with clear, step-by-step instructions to assist you in completing the form accurately.

Follow the steps to complete your 2020 Ct 200 V form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Provide your employer identification number (EIN) in the designated field at the top of the form. This number is crucial for identifying your corporation.

- Select the primary return type by entering the form number of the corporation tax return you e-filed, omitting any slashes or dashes (e.g., CT3, CT3S, CT186). This is a required field.

- Input the tax period start and end dates in the specified format (mm-dd-yyyy). Ensure that these dates correspond to the period for which you are filing.

- Indicate the type of form e-filed by selecting from the relevant options provided in the form.

- Enter your legal corporation name, and if applicable, fill in the mailing name if it is different from the legal name.

- Complete the address section with your number and street or PO box, city, state, and ZIP code.

- Provide your business telephone number in the required format.

- Detail the amounts due by entering the New York State (NYS) tax due amount and any Metropolitan Transportation Authority (MTA) surcharge amount, if applicable.

- Clearly state the total payment amount enclosed. This should match the total amount due stated on your e-filed return or extension, and should not include any federal tax owed.

- Once you have verified all information for accuracy, you can save changes to the form, download it for your records, print it, or share it as needed.

Complete your 2020 Ct 200 V form online today to ensure timely processing of your corporation tax payments.

if you filed your new York city return or extension electronically but did not pay the amount due electroni- cally with the return, you may file a paper nYc-200V with a check, or you may file a Form nYc-200V online and pay online at nyc.gov/eservices.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.