Loading

Get Tx Twc C3dom 2007-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX TWC C3DOM online

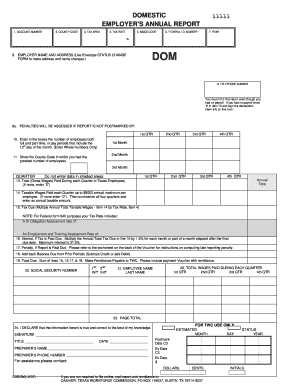

Filling out the TX TWC C3DOM online is an essential step for employers to report their annual payroll data to the Texas Workforce Commission. This guide provides detailed instructions to help users navigate through each section of the form with ease and accuracy.

Follow the steps to complete your TX TWC C3DOM form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your account number in the designated field to identify your employer account.

- Input your county code to indicate the location of your business.

- Specify your tax area to ensure proper tax handling.

- Fill in the tax rate applicable to your company.

- Provide the NAICS code that corresponds to your business activities.

- Enter your federal I.D. number for tax identification.

- Select the year for which you are submitting this report.

- Record your employer name and address. Use the Envelope STATUS CHANGE FORM to make any necessary updates.

- Input your telephone number for contact purposes.

- If you had no payroll, report '0' in item 13 and ensure to sign the declaration in item 24.

- Indicate the postmark date by which the penalties will apply.

- In the boxes provided, enter the number of employees for each quarter, ensuring to include both full-time and part-time employees.

- Identify the county code where you had the highest employee count.

- Document the total gross wages paid to Texas employees during each quarter. If there were no wages, enter '0'.

- Record taxable wages paid each quarter, ensuring it does not exceed the annual maximum per employee. Total the annual taxable amount.

- Calculate the tax due by multiplying the annual total taxable wages by the tax rate.

- If applicable, include interest for any past due tax.

- Add any penalties for late reporting as instructed in the worksheet on the back of the voucher.

- Include any balances due from prior periods.

- Sum all amounts to determine the total due and prepare payment to TWC.

- Complete the social security number field.

- List the names of employees as required.

- Finalize the form by signing and dating it in the designated area.

- Review the entire form for accuracy before saving changes, downloading, printing, or sharing.

Complete your TX TWC C3DOM form online today for a smooth filing process.

Filling out a work search log requires tracking your job search activities consistently. Ensure that you document each job application, interview, and networking opportunity. Utilizing tools associated with the TX TWC C3DOM can streamline this process, making it easy for you to maintain an accurate and organized log.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.