Get Millennium Trust Company Ira Distribution Request 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Millennium Trust Company IRA Distribution Request online

Filling out the Millennium Trust Company IRA Distribution Request is a crucial step for users seeking to manage their retirement funds. This guide will walk you through the online process, ensuring that you complete each section accurately and efficiently.

Follow the steps to complete your distribution request with ease.

- Click ‘Get Form’ button to access the distribution request form and open it in the editor.

- Begin by providing your personal information including your name, address, and Social Security number. Ensure all details are accurate to avoid processing delays.

- Next, identify your IRA account by entering your account number. This helps the company locate your funds promptly.

- Specify the type of distribution you are requesting. This may include options such as a full distribution, partial distribution, or specific taxable events.

- Indicate your preferred method of receiving the funds, such as a check, electronic transfer, or another method as applicable.

- Complete any additional fields that relate to tax withholding preferences and ensure you understand the implications of your choices.

- Review all provided information for accuracy before submission. Make sure that no fields are left incomplete.

- Finally, save your changes, then proceed to download or print the completed form for your records. You may also share it if needed.

Complete your distribution request online today to manage your retirement funds effectively.

Millennium Trust empowers clients with trusted expertise, exceptional service and access to a wide range of custody solutions. Whether you are managing alternative assets, investment accounts or retirement funds, we are uniquely qualified to service your needs.

Fill Millennium Trust Company IRA Distribution Request

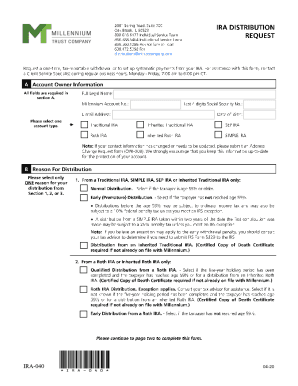

Use the Millennium Trust Company IRA Transfer Form. Millennium Trust requires their specific IRA transfer form titled "IRA Distribution Request." Keep in mind that a withdrawal may lead to taxes and penalties, so you may want to consult with a tax or financial adviser before requesting a distribution. Request a one-time, tax-reportable withdrawal or to set up systematic payments from your IRA. To request an RMD from your IRA, you can access and download the appropriate form here. Section A: Account Information. ▫ Select the type of IRA desired. Please submit forms to Millennium Trust by: □ Mail: Millennium Trust Company. Attn: ARP Department.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.