Get Tx I-162 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX I-162 online

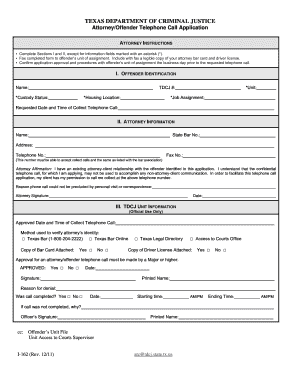

Filling out the TX I-162 form is an important step for attorneys seeking to schedule confidential telephone calls with offenders. This guide provides a clear and supportive approach to completing the form online, ensuring that all necessary information is accurately provided.

Follow the steps to fill out the TX I-162 form online effectively.

- Click ‘Get Form’ button to obtain the TX I-162 form and open it in your preferred document editor.

- In Section I, provide the required offender identification information. Fill in the name of the offender and the TDCJ number. You can skip the fields marked with an asterisk.

- Still in Section I, include the requested date and time for the telephone call. Ensure that the date and time are feasible for both you and the offender.

- Proceed to Section II to fill out your attorney information. Enter your full name, state bar number, address, and both telephone and fax numbers. Make sure your fax number can accept collect calls.

- Read and acknowledge the Attorney Affirmation statement. By providing your signature and date, you confirm your attorney-client relationship with the offender and your permission for collect calls.

- Finalize your application by checking all provided information for accuracy before submitting the form. Make sure to attach a legible copy of your attorney bar card and driver license.

- Fax the completed form to the offender’s unit of assignment. Confirm the application and procedures with the unit the business day before the scheduled call.

Complete your TX I-162 form online to facilitate the necessary communication with your client.

Yes, IRA contributions are typically considered above-the-line deductions if you meet certain requirements. This means you can deduct contributions from your taxable income, subject to annual limits and eligibility based on your income level. Knowing how these contributions impact your taxes is essential for effective financial planning. For assistance with IRA contributions and the TX I-162 process, US Legal Forms provides helpful resources.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.