Loading

Get Form Fit-20

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form FIT-20 online

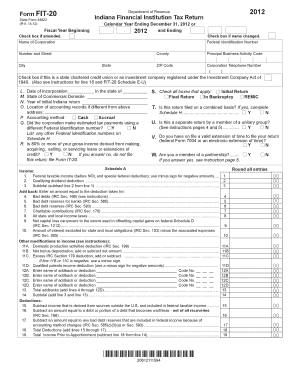

Completing the Form FIT-20 online is an essential process for financial institutions in Indiana to report their tax obligations. This guide provides clear and user-friendly instructions to help you navigate each section of the form efficiently.

Follow the steps to complete the Form FIT-20 online.

- Press the ‘Get Form’ button to access the online version of the Form FIT-20 and open it in your preferred online editor.

- In the top section of the form, enter the fiscal year beginning and check the box if you are submitting an amended return. Input the calendar year ending in the specified section.

- Provide the name of your corporation, checking the box if the name has changed. Enter your federal identification number and the address of your corporation, including number, street, city, state, county, and ZIP code.

- Fill in the phone number for the corporation and indicate if you are a state chartered credit union or registered under the Investment Company Act of 1940 by checking the appropriate box.

- Record the date of incorporation and state of commercial domicile. Also, indicate the year of your initial Indiana return.

- List the location of your accounting records if it differs from the provided address. Select your accounting method as either cash or accrual.

- Indicate whether the corporation made estimated tax payments under a different federal identification number and specify if 80% or more of your income derives from loan-related activities.

- Check all relevant statuses such as final return, initial return, or bankruptcy. Indicate if the return is filed on a combined basis and if it is a separate return for a member of a unitary group.

- Complete the income section by rounding all entries and entering the required amounts in the appropriate lines for federal taxable income and related deductions.

- Proceed through the deductions and tax calculations sections, ensuring you provide accurate inputs as per the instructions for each line.

- Review all entries carefully, ensuring accuracy and compliance with all requirements. Upon completion, you can save changes, download, print, or share the form based on your needs.

Start filling out the Form FIT-20 online today for a streamlined tax reporting experience.

Find printable IRS Federal Tax Forms & instructions here or call 1-800-829-3676. Find printable State of Indiana and County Tax Forms here or order by phone at 317-615-2581 (leave your order on voice mail, available 24 hours a day).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.