Loading

Get Pa Dor 83-e669 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA DoR 83-E669 online

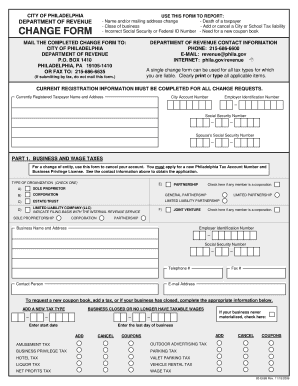

This guide will help you understand how to fill out the PA DoR 83-E669 online. Whether you need to report a name change, address change, or any other updates, following these steps will ensure you complete the form accurately.

Follow the steps to complete your form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing your current registration information. Enter your currently registered taxpayer name, mailing address, city account number, and Social Security or Federal ID number in the designated fields.

- Next, move to Part 1 which pertains to business and wage taxes. Indicate your type of organization by checking the appropriate box (sole proprietor, corporation, partnership, etc.). Be sure to fill in your business name, address, and Employer Identification Number.

- If applicable, provide details for new tax types to be added or indicate if your business has closed. Enter the start date for any new taxes and the last day of operations if you are reporting a closure.

- Proceed to Part 2, which is for school income tax. Enter any corrected Social Security numbers and taxpayer names, along with a new address if relevant. State the reason for cancelation if applicable.

- In Part 3, which covers business use and occupancy tax, fill in the property address and any associated account numbers. Provide a cancellation date and reason if necessary.

- Lastly, check Part 4 for employee earnings tax updates. Include any corrected Social Security numbers, taxpayer name, and contact details. State the reason for cancelation where appropriate.

- Once you have filled out all necessary fields of the form, review your information for accuracy. You can then save your changes, download the completed form, print it, or share it as needed.

Complete your PA DoR 83-E669 form online today for a smoother process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Typically, you have three years from the original due date of the return to amend your PA tax return. This includes any extensions granted for filing. Using the PA DoR 83-E669, you can efficiently submit your amendments within this timeframe to ensure compliance. It's always a good idea to check for any updates or changes from the Pennsylvania Department of Revenue regarding these deadlines.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.