Loading

Get Uk Bor286 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK BOR286 online

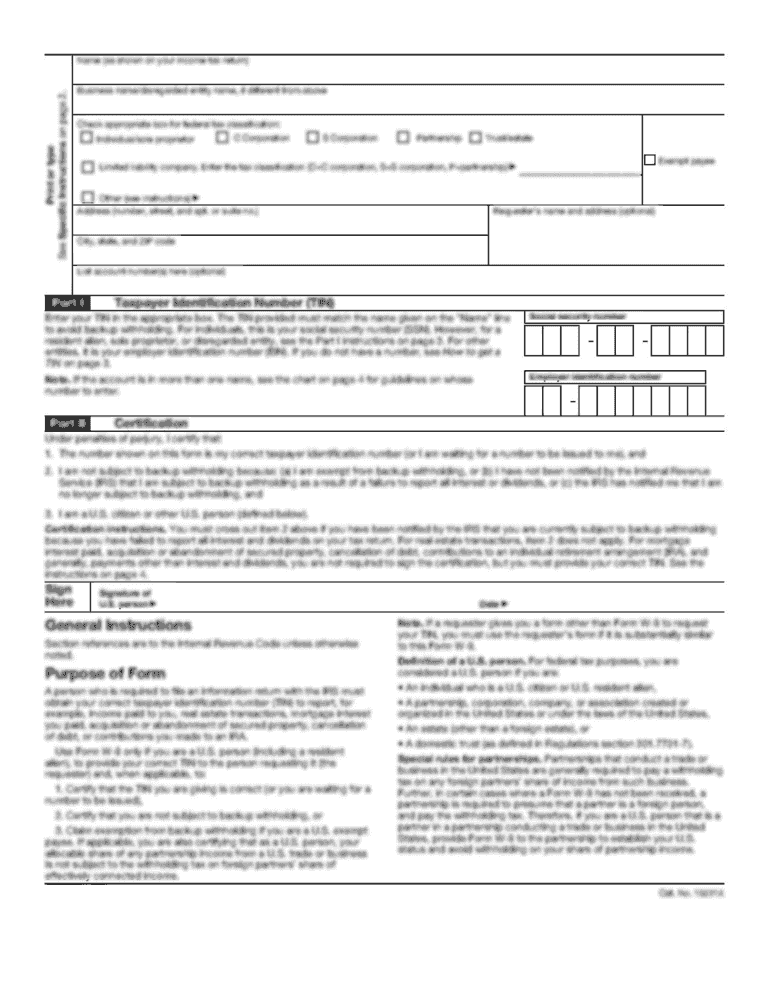

The UK BOR286 form is essential for addressing concerns about incorrect Customs Duty or import VAT charges on parcels received by post. This guide provides clear, step-by-step instructions to help users complete the form accurately and effectively.

Follow the steps to complete the UK BOR286 form online

- Press the ‘Get Form’ button to access the UK BOR286 form and open it in your preferred online editor.

- Begin filling out the section for details of the UK importer or consignee. Enter the name of the importer, their phone number, VAT registration number (if applicable), and their full address, including the postcode.

- Locate the charge reference number, typically starting with ‘EC’ or ‘ZA’ and ending with ‘GB’. Enter this number in the designated field.

- Provide your email address for direct communication regarding your submission.

- In the section detailing the Customs Duty or import VAT incorrectly charged, clearly explain your reasoning. Include as much information as possible about the location of the goods and any discrepancies you believe exist.

- Ensure you attach the required supporting documentation, which includes a Customs black and white charge label, the customs declaration form, an invoice or receipt, evidence for returned goods if applicable, and any relevant confirmations for overseas students or antiques.

- If your parcel contains personal gifts, include a confirmation from the sender detailing the gifts' values and intended recipients.

- Complete the declaration section by providing your bank or building society details, certifying that all given information is accurate, and signing where indicated.

- Finally, review the completed form to ensure all information is filled out correctly. Once satisfied, submit the form along with the supporting evidence to Border Force at the specified address.

Start filling out your documents online now for a streamlined process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You no longer have to pay Customs duty for goods up to the value of £135. However, you will still be required to pay import VAT and excise duty where applicable.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.